Our insights

Like many people, you may have worked in multiple jobs with various pension schemes run by different providers.

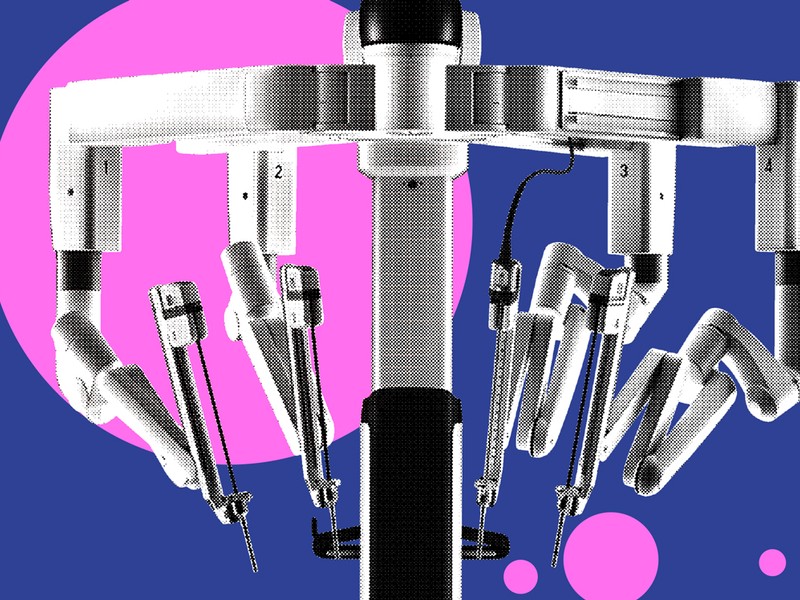

When Intuitive was founded in California in 1995, the field of robotic-assisted surgery (RAS) was conceived.

Thanks once again to everyone who completed the survey on preferences for Prospects magazine and wider communications from JM Finn which we included with our summer edition.

A spotlight on three of the companies we’ve met during the past quarter. We met or spoke with the companies below and you can learn more on any of these by contacting the person at JM Finn with whom…

Michael Law, Paraplanner at JM Finn delves into the possible circumstances where purchasing an annuity may be beneficial, and explains why annuity sales are currently elevated.

The global clean energy industry has experienced rapid growth over the past decade, driven by governmental and corporate commitments to environmental and sustainability initiatives. Over time, these…

As part of our focus on providing a high quality, personalised investment service, we look to support our investment managers in their decision making when it comes to constructing client portfolios.

Glossary of key terms for this issue

To support our investment process, we have a dedicated research team who continually meet with companies in person to assess their suitability for investment.

Sir John Royden explains ‘term premiums’ in bonds – and how the JM Finn research team use them as a barometer to spot potential opportunities in corporate and government bonds.

You might well have heard your Investment Manager referencing ‘valuation multiples’ when discussing your investments.

After a tremendous 26 years at JM Finn, our Chairman, and former CEO, Steven Sussman retires at the end of this year.

Investment Director and Head of York, York Office

2023 stands out as another difficult year for investment markets and the wider economy. Since our last edition of Prospects, markets have continued to display the kind of volatility that has typified…

If you like this article, follow us for more insights.

To receive more content like this subscribe today.