After years in the wilderness, many bonds (including government bonds, known as ‘gilts’) are currently generating their highest returns since 2007 – and consequently have become of renewed interest to investors. At JM Finn we calculate and monitor bond ‘term premiums’ to give us insights into trading in bonds and gilts and to discover potential investment opportunities for our clients.

What are bonds and ‘term premiums’?

At its simplest, a bond can be thought of as a type of IOU or a loan. In the same way that we might expect to receive a higher interest rate from a savings account where we cannot access the money for a number of years, the ‘term premium’ of a bond can be thought of as the extra premium that investors demand for holding longer-dated bonds instead of shorter-dated bonds. If this risk is high, investors will demand higher ‘yield to maturity’ (YTM) to compensate them for the risk of missing out on higher deposit rates in the future. ‘Maturity’ is the date the repayment on the bond is due, and the yield to maturity is the average annual yield that an investor would get from the bond each year until it reaches maturity. The yield to maturity includes both (a) interest payments and (b) capital gains or losses.

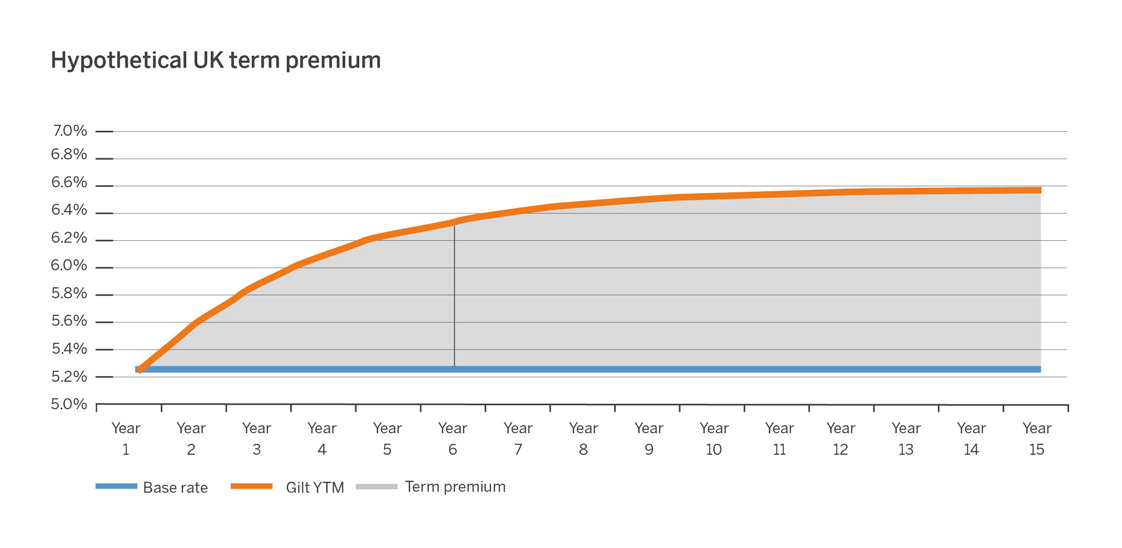

The concept of a term premium is illustrated by the hypothetical example in the first chart, which compares the yield of gilts (shown by the orange line) to base rates (shown by the blue line). In this example a gilt maturing in year 6 has a yield to maturity of 6.36%; in other words the investor will receive an average annual return of 6.36% on the purchase price.

The base rate is assumed to remain unchanged at a rate of 5.25% per year, which indicates that an investor depositing money with a bank for the same 6-year period could expect to earn 5.25% each year. The ‘term premium’ is the difference between the gilt yield and the base rate – so over the six years, the term premium of the gilt is 1.11% (6.36% - 5.25%, or the orange line minus the blue line).

In reality there is of course always a risk that inflation could push interest rates higher or the government could over-issue gilts and drive yields higher, so both base rates and yields could be subject to change.

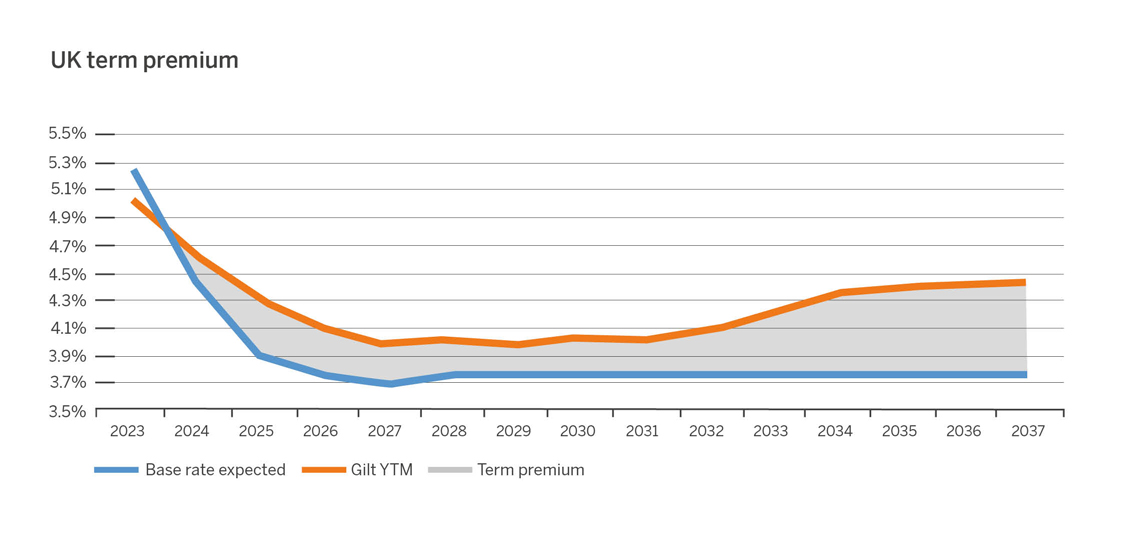

Today’s term premium (i.e. the additional return for longer-dated bonds) for bonds has to be estimated by seeing what people expect base rates to be in the future. I turn to the gilt market to get the yield to maturity rates for gilts, and the futures markets to get my estimates of what base rates are going to be. The below chart shows what the UK curve looks like on the assumption that the implied base rate stays constant from 2031 onwards.

You can see from the gap between the base rate line and gilt yield to maturity lines in the chart that a UK term premium persists for much of the next eight years but then increases further after 2032, suggesting a perception that investment in longer-dated UK gilts will become riskier thereafter. Factors exacerbating this perceived risk include concerns about the lasting effect of raised inflation, a weak pound or government debt funding.

As ever, we continue to closely monitor term premiums and bond yield rates throughout global markets in order to support our Investment Managers’ strategies for client portfolios, and to try to ensure that we have an optimum mix of investments to generate returns for our clients.