Insights

Updates to reporting requirements under Automatic Exchange of Information (AEOI) regime – could your trust be affected?

Andrew Mann explains why the consumer goods giant has moved its ice cream brands into a newly listed company.

Andrew Mann asks whether we are witnessing the beginning of a more serious correction in AI stocks, or simply a necessary pause after a period of rapid growth.

JM Finn’s view on the 2025 All-In Summit convention of Silicon Valley leaders.

With the announcement of a late November Budget, will Keir Starmer follow Mark Carney’s advice to reduce the tax burden on Britain’s middle classes? Unlikely, says Investment Director Andrew Mann.

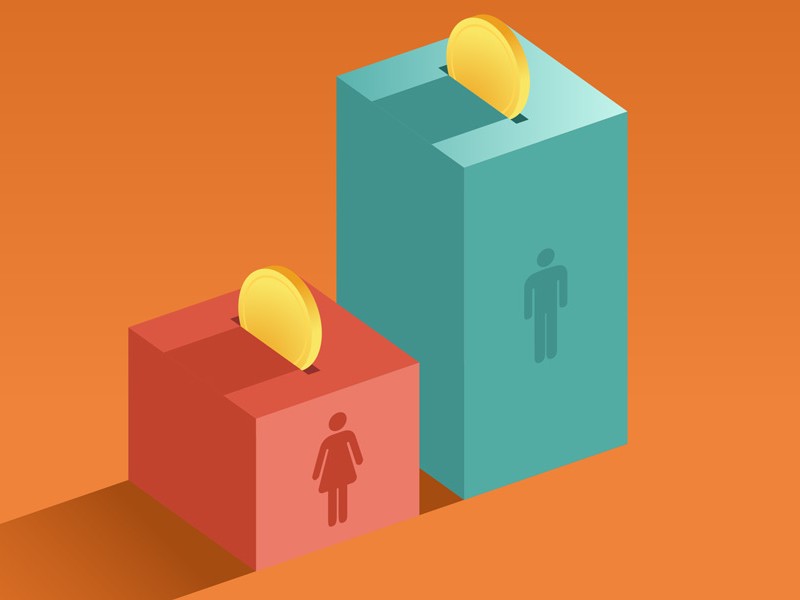

JM Finn launches new guide to pension planning, aimed at helping women to redress the UK’s £85,000 gender gap in pension size at retirement.

With tech behemoths earmarking significant funding for AI in the UK, the country is on course to develop as a global AI hub, writes Investment Director Andrew Mann.

Firm bolsters Personal Injury and Court of Protection investing capability.

JM Finn has added to their investment management team in the Bristol office by hiring Andrew Theban.

Investment Director Andrew Mann asks when the multi-billion-dollar investment in AI from tech behemoths is going to yield returns.

There is renewed interest in investment in the UK, particularly among US investors seeking alternatives to investing domestically, writes Investment Director Andrew Mann.

Wealth Planner Charles Barrow explores some of the most effective tools available to grandparents looking to invest for the benefit of younger generations.

Despite the FTSE 100 reaching record highs as investors seek alternatives to US stocks, the UK’s damp jobs market and dearth of initial public offerings mean the UK economy leaves much to be desired,…

Q2 has been marked by significant market volatility, writes Investment Director Simon Temple-Pedersen. Despite geopolitical tensions and the S&P 500's dramatic swing, quality businesses are adaptable…

Andrew Mann explores the significant decline in the US dollar's value in 2025, examining the factors driving this weakness and its implications for UK investors.

Investment Director Charles Bathurst-Norman covers the salient points from Q2 2025: Trump is pressuring the US Federal Reserve to cut rates, while tax rises in the UK appear to be on the cards.

Wealth planner Luke Audritt explains the steps to take to check if your retirement and pension plans are on track.

The latest in our Meet the Manager video series with Co-Fund Manager of JM Finn’s Investment Management Service. James talks about his career to date, the benefits of the Investment Management…

The question of possible measures to increase the UK’s energy independence has come back into the spotlight amid this week’s events in the Middle East.

Head of Investment Office Jon Cunliffe covers what the US involvement in the Israel-Iran conflict could mean.

Optimistic outlook for the UK, Eurozone and Asia as US exceptionalism dwindling, writes Head of Investment Office Jon Cunliffe.

As the UK’s debt-to-GDP ratio reaches the highest level since the 1960s, UK gilt yields will give an indication of whether markets have confidence in this week’s spending review.

As an increasing number of estates become liable for inheritance tax, discounted gift trusts are coming into the spotlight as a possible route for IHT mitigation.

Meet Rebecca, Wealth Planner in our London office. In this video she provides insight into the goals for the wealth planning team for the rest of 2025, how the team are helping clients manage the…

Read top tips for personal taxation from our Wealth Planning team for the year ahead.

Watch our video from JM Finn’s Head of IT Jon Cosson for top tips to create a strong password, and steps to take if your email account is compromised.

Now that the dust has settled since the Budget in October, Andrew Banks, Senior Investment Manager, explains why the changes to Business Relief may have had unintended consequences.

Our Wealth Planning team cover some of the key points you need to know on estate planning – including the impact of the Autumn Budget.

Can regulation match the extraordinary rate of progress in AI? That is the question posed by the most world's powerful figures in tech at the 2024 All-In Summit in California. Read our special report…

As the US election draws closers, watch our exclusive webinar featuring Freddy Gray, Deputy Editor of The Spectator and JM Finn Investment Director Freddy Colquhoun, covering all the key points to be…

In our latest webinar, Anna Murdock, Head of Wealth Planning and Simon Wong, Senior Wealth Planner cover the key points to know on pensions and retirement planning.

Launched in 1999, this spring marks the quarter century milestone since the Individual Savings Account (ISA) was first introduced in the UK, superseding the Personal Equity Plan. We take a look at…

Andrew Banks, Manager of JM Finn’s Inheritance Tax Portfolio Service, discusses the reasons for the sharp rise in people being liable for inheritance tax and discusses five potential ways you could…

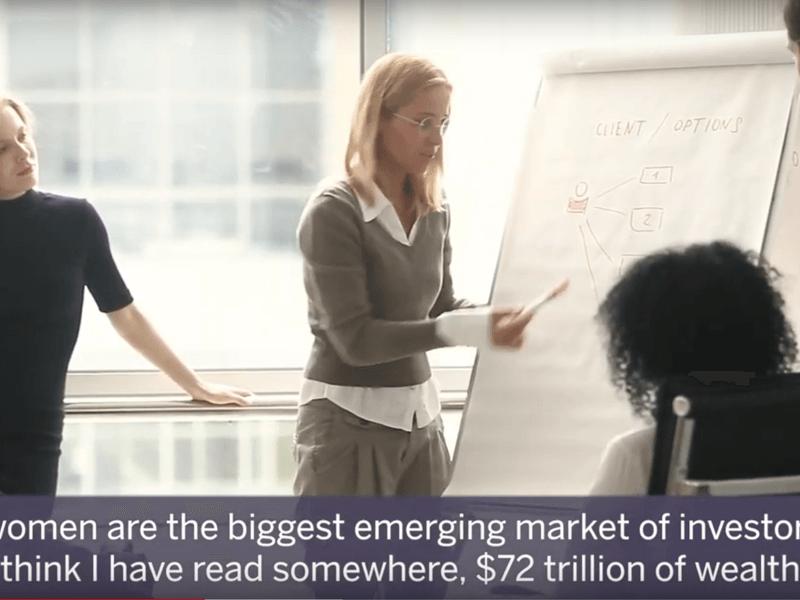

Everyone’s wealth journey is different and depends on their personal objectives and circumstances. However, there are common experiences that women face, which can have a significant impact on their…

Consultant Katie Larnach takes a closer look at the ways in which the financial behaviours of affluent women are rapidly changing.

Despite women gradually closing the pay gap and advancing in the world of work, they are still far less likely than men to invest money: and this is contributing to a staggering £599 billion…

A quick guide on the key points for UK charities to be aware of when investing.

NPS scores are used to measure the extent to which a company’s customers would recommend it to others.

Chartered Financial Planners from the JM Finn Wealth Planning team give an overview of the choices available to Junior ISA (JISA) account holders when they turn 18.

In you hold a self-invested personal pension (SIPP), when you reach the age of 55 you will have numerous options available to you to access it. This article explores those choices and the possible…

Three of our investment experts comment on what 2024 may bring for economies, investors and markets.

The Ace of Blades rowing team are so close to the start line. Discover what kind of physical and mental preparation it has taken to get them there.

How US companies are attempting to change the face of our everyday lives through AI, and striving to achieve a competitive advantage.

Leaving money in the bank may often mean that its value falls in real terms.

As our population ages and life expectancy grows, more of us will need to pay for costly long-term care in later life. Could long-term care insurance be a solution?

High exit fees are set to be removed by some wealth managers - and moving your investments to a new provider can be a straightforward process.

Charles Bathurst-Norman reviews the quarter and explains his preference for investing in a diversified portfolio of direct equities.

Whatever stage of life you are at, you’ll have a dream. Be it to buy a house, fund your children’s education or travel the world, investing in a portfolio of stocks and shares can make your hard…

Experts from Affordable Art Fair share their tips on environmentally friendly art buying.

Building your home collection is a truly unique and personal experience. Whatever stage you’re at in your collecting journey – curious newbie or established collector – there’s always something new…

Consolidating pensions is the process of combining multiple pensions into a single scheme. Could combining your old pensions be the right option for you?

Brian Tora delves into the implications of this month’s economic indicators.

Sir John Royden, Head of Research, examines the potential impact of a leadership change in the next UK election.

As interest rates hit a 15-year high, Brian Tora asks how long they could persist for.

The American government debt ceiling, cost of living, and oil prices have dominated recent headlines. How have they impacted markets?

Wealth management firm JM Finn is sponsoring the Ace of Blades rowing team, who will be completing the Atlantic Row later this year.

Brian Tora provides insight into current factors impacting markets and investment decisions.

JM Finn, lead sponsor of the Ace of Blades rowing team sat down with the crew to learn more about their lives, jobs, and incentives for attempting the 3000-mile row.

Investment director, Paul Tyndall suggests that, thanks to falling inflation, there are grounds for optimism for investors.

We spoke to Iona Garton, Senior Investment Manager at JM Finn on her career to date within financial services and her advice for others considering a career in the sector.

Food inflation, Northern Ireland protocol fallout and the upcoming budget have impacted markets.

It is never too late to start defining your financial goals. Paraplanner Uday Tuladhar makes some suggestions to the over 50s for improving their financial wellbeing.

It is never too late to start thinking about your financial goals. In this article, paraplanner Uday Tuladhar raises some useful points to be considered

What impact have the policy changes, mini-budget and inflation had on markets? Brian Tora provides his thoughts.

Unless you are approaching retirement, thinking about your pension and retirement plans can seem unrelatable, possibly unnecessary and certainly boring. Many a financial services provider aims to…

Optically, emerging markets would not be the obvious choice when considering investing new funds given the current macro-economic and geo-political backdrop. Investment Director, Freddy Colquhoun…

How we extract, manufacture, use and dispose of earth’s finite resources is becoming increasingly critical to the survival of all life on earth. Isabel Kwok looks at the recycling sector as an…

What is Tammy Beaumont expecting from the rest of the World Cup? Read below.

Meet Karen, Senior Investment Manager in our London office. In this video she provides her insight on how she is positioning portfolios, areas of the market that excite her and her primary challenges.

What is absolute return? Absolute return is the return that an investment portfolio receives over a specified period. Read below for more detail.

Read our latest market commentary from Investment Director Freddy Colquhoun where he discusses inflation, vaccines and much more.

What makes a good investment strategy during uncertain times? Read below to see what Investment Manager Charles Bathurst-Norman is planning.

JM Finn hosted a conference in-person and virtually, bringing together experts to educate our audience on a range of topics.

Carole Annett of Country & Town House magazine offers simple, practical ideas to turn your home into a castle

Bond star Daniel Craig would rather give away his wealth to charity than to his daughters. Whatever your view, it is important to plan for it to ensure your wishes are fulfilled.

Mark Powell, head of Charities at JM Finn, discusses why such excitement surrounding inflation has arisen, and a possible outcome.

JM Finn hosted a virtual conference in May, bringing together some experts to share their insights.

Meet Isabel, Investment Manager at our Bristol office. In this video she provides her insight on the biggest challenges for the firm and the growing interest in Environmental, Social and Governance…

The Vauxhall end stand will now be known as the JM Finn Stand, extending the partnership for a further five years.

With the tax year end fast approaching and many allowances offered on a ‘use-it-or-lose-it basis’, now is the time to consider implementing smart financial planning strategies, both now and going…

Meet Antonia, Senior Investment Manager at our Leeds office. In this video she provides her insight on the biggest risks for investors and how she's adapted to fulfill her client's needs since…

Owning an asset directly is not always achievable or in line with your overall investment objective. Henry Birt uses the current Bitcoin rally to explore how else investors might join the bandwagon.

James Godrich explains what he has learnt from planes, jazz, Jonny, cricket & doctors that can be applied to investment management.

Henry Birt of JM Finn’s research team looks into the mechanics of the world’s largest cryptocurrency, Bitcoin

The vaccine roll out remains shrouded in unpredictability and uncertainty but there are a few issues we can already see on the horizon, some of which we have the tools to solve.

It's never too early to start estate planning so you can leave more to those you love. Simon Wong provides clarity on some common pitfalls that you might be unaware of.

Current economic growth is considered to be not too hot (to push up rates and inflation) and not too cold (to push down employment and share prices). John Royden unpicks this "Goldilocks" analogy.

With sensible planning it is possible to reduce the tax bill that you leave behind for your loved ones. Clare Julian looks at Inheritance Tax and suggests areas that investors should explore

As we endure yet another lockdown here in the UK, the outlook may appear rather bleak but the three main headwinds investors faced last year, namely the pandemic, the US election and Brexit are all…

Christmas week hardly got off to a promising start for our stock market, but a modest recovery saw much of the damage repaired, though sentiment remained fragile.

JM Finn hosted a virtual conference in December, bringing together some experts to share their insights.

Freddy Colquhoun looks ahead to next year from an asset allocation perspective and suggests the UK could be the surprise market.

With yet more vaccines coming on stream, markets have continued to be buoyed by the belief that some form of normality will return by spring next year.

John Royden looks at what is in store for the US.

Brand ambassador Tammy Beaumont reports from Sydney on the Women’s Big Bash.

Our own Footsie index has been struggling of late. A six-month low was struck as investors went into a risk-off mode as fears grew of the economic damage that was being wrought by the pandemic.

I bought my first shares on the London Stock Exchange back in the mid-1960s.

Justice Ruth Bader Ginsburg (affectionately referred to as RBG) died last week after serving on the Supreme Court for 27 years.

Trump is trailing in the polls but Biden is not certain of victory.

Biden is leading in the polls but is not certain of victory.

My investment considerations at present are predicated on the basis that Joe Biden will win the next election.

Freddy Gray, editor of the US Spectator talked to us about the battle for the White House. Read the transcript here.

September 21st marks World Alzheimer’s day and a timely reminder of the pain of dealing with brain disorders.

Atticus Kidd looks at the new online service recently launched to help people safeguard their finances and wellbeing.

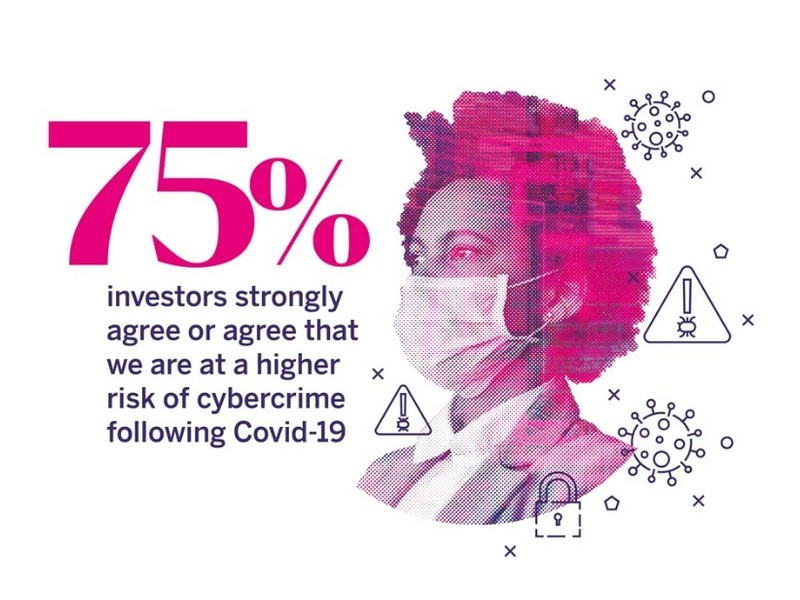

A new survey commissioned by JM Finn has found a high concern of cyber crime amongst UK investors with concerns notably heightened due to increased online activity during Covid-19.

Andrew Banks looks at the Alternative Investment Market on its 25th anniversary.

Head of research, John Royden looks at a bellwether stock in his quest to determine when normality returns.

John Royden, Head of Research at JM Finn looks at how the UK’s trade deal negotiations might be impacted by increased tensions between the US and China

Marcus Holden-Craufurd, Investment Director at JM Finn looks ahead at some of the primary concerns for private clients.

In these strange times there are many people sitting at home unable to work, care for their loved ones or even keeping themselves busy.

One of the most discussed themes recently has been the impact of the coronavirus on dividends, with nearly £20 billion of upcoming payments in the UK cancelled.

As the recent period of market volatility kicked in, I was in the fortunate position that all three funds that I manage had a small overweight cash position.

Coronavirus provides a complex set of problems for politicians who need to balance very challenging medical and economic decisions.

It’s never been more important to start investing early. And this is particularly important if you’re a young woman as you don’t want to have regrets as you get older.

"Baby boomers will be looking at whether they have sufficient income for retirement, possible care costs and how to pass down wealth to their children.” Anna Murdock discusses our wealth planning…

Meet Lucy, 2019’s Fund Manager of the Year (Female), talking about her investment approach and some of the wider issues facing the industry.

In many respects, intergenerational wealth challenges follow a tried and tested path.

Our asset allocation committee is one example of this, via their monthly output showcasing their views on a global basis; this is then complemented by a sectoral view from the stock selection…

“Expanding on the idea of investment for everyone” Will Ramsay, Founder and CEO of the Affordable Art Fair talks about our exclusive partnership with the fair.

“Expanding on the idea of investment for everyone” Jennifer Conner, UK Regional Manager of the Affordable Art Fair talks about our exclusive partnership with the fair.

Many investors avoid allocating to Japan justifying their decision by its cyclicality, stubborn disinflation, challenging demographics and the usual concerns surrounding weak economic growth.

Watch our video to see how our online portfolio valuation tool can meet the requirements of today's investor.

We asked Investment Director Chris Barrett to answer some common questions about private wealth management.

Cosmetics have been around for centuries but in the modern era of social media, where selfies are uploaded at breakneck speed and beauty influencers garner huge followings, interest in aesthetic…

Any aspiring parent wishing to send their children to private school will be fully aware of the huge cost to do so, with the average annual cost of a private day school at around £14,000 rising to…

Our CSI Fund Manager, James, talks us through the sectors of the market he is interested in at the moment.

As part of our focus on providing a high quality, personalised investment service, we look to support our investment managers in their decision making when it comes to constructing client…

The month of March is a month synonymous with the coming of spring.

BCKR is an organisation founded by lawyers to help lawyers broaden their horizons and offer opportunities to further their careers upon leaving private practice.

So, if our nation now wants to remain, and ditto for our Parliamentarians, then political gravity leads you to some kind of soft Brexit and I suspect Europeans want this as well. Europe’s need to…

As part of our partnership with BCKR, JM Finn offered a breakfast seminar to help attendees learn how to get to grips with a formal report and accounts.

Want to know why steering clear of global investment might not be the right approach? Watch this short video by our research analyst, James Godrich, to hear the three reasons to have a rethink.

England’s cricketers have high expectations for the Women’s World T20. Whilst their male counterparts were hoping the Sri Lankan weather didn’t ruin their party, the women’s first game in St Lucia…

In 2002 when asked about the lack of evidence linking Saddam Hussein to the supply of weapons of mass destruction to terrorist groups, Donald Rumsfeld replied with the now infamous quote, “as we…

BCKR is an organisation that encourages lawyers and their firms to have greater involvement in the outside world.

Since April 2015, ISA investors have been able to pass on the value of their tax-free ISA to a spouse or civil partner on death through an ‘additional permitted subscription’ (APS). However, an…

JM Finn Global Conference from Oliver Tregoning on Vimeo.To give our clients some insight into the kind of research that our investment managers and research analysts do on a daily basis, we gathered…

But “safe” should not be taken out of context. In mid-2013 the 3.5% of 2068 were trading at close to £100. As interest rates fell, the gilt rallied to a peak of just under £200 by August 2016; within…

Nick Vetch, Co-founder and Executive Chairman of Big Yellow Group plc shared his insights of non-executive roles with BCKR.

Cooper Companies (Cooper) is an S&P 500 US-based business. It is made up of two divisions; CooperVision (c.75% of revenue) and CooperSurgical (c.25%). CooperVision is higher margin and therefore…

In a world where traditional terrorist threats tended to be group based and focused on destruction to property, we are now witnessing “cultish terrorism” and extremists focusing their efforts on mass…

JM Finn has long been a supporter of BCKR, an organisation that encourages lawyers to have greater involvement in the outside world.

The Financial Conduct Authority (FCA) is urging over 55s to check investment opportunities are genuine before they part with their money.

On the 5th March 2009, following some of the more turbulent times in our economic history, the BofE cut our base rate to 0.5% and announced that it was to start the process of pumping tens of…

Robotics and Artificial Intelligence (AI) alongside other new technologies are generally expected to provide a significant boom for the global economy.

LIVESLondonFAMILYSingleEDUCATIONRadley College and Durham UniversitySTARTED AT JM FINNJanuary 2017ALTERNATIVE CAREER IF NEEDEDCricket commentatorFIRST JOBGraduate trainee accountant at PWCSUMMER…

What does the new Parliament look like? Well, if the Tories end up with 319 seats and the DUP vote with the Tories, then together the Tories/DUP alliance ends up with 329 seats.

Entities are required to obtain a unique identifier as part of the new rules under MiFID II or suffer the consequences of their investment manager being unable to transact on their behalf.

My forays into politics have a chequered history. Back in 1997 I volunteered to help the Conservatives canvass in Fulham and Putney.

In curling the skill is in brushing the ice just enough to help the stone land in the sweet spot. Too much brushing and the stone will overshoot the target; too little and it might never get there.

A vast country, of some 1.3 billion people, India is now firmly on the radar as the fastest growing major economy in the World – forecast widely to become the third largest. I have two clear messages…

More details will follow in an explanatory letter to all clients and a follow-up article in the summer edition of Prospects. I mention this because one of the areas that the industry is struggling to…

Following the past seven years of slow but steady growth, low productivity gains and zero interest rates you'd be forgiven for forgetting what inflation feels like.

With the upcoming Referendum, one topic of discussion that we can’t seem to get away from is the European Union.

The award for Best Discretionary Service at the 2016 City of London Wealth Management Awards was presented to JM Finn & Co at a ceremony at The Guildhall.

As we march into the Brexit vote on 23rd June, all eyes will be on the polls. But before you place too much emphasis on the polls, remember how they failed miserably in the UK general election last…

With just under three months until the EU referendum, nobody can predict what will happen.

With more than one hundred days to go to the UK’s EU referendum, the odds on the runners and riders to succeed David Cameron have altered considerably.

This week’s two day summit on the EU-UK’s negotiations may see some leaders struggling to focus their minds.

The lie of the political landscape on the UK’s Europe referendum has become a little clearer now.

One of the principal features of the enduring commodity “super-cycle” that permeated the early parts of this decade was the rise of Sovereign Wealth Funds (SWFs).

The whirligigs of time have brought George Osborne his revenge. When he was made Chancellor, the Labour benches were all ready to put him down over his willowy figure and public school, even sneery,…

The Bureau of Labor Statistics (BLS) in the United States showed a hike in its jobs report of 271,000 new hirings on Friday, despite attrition in the mining and oil & gas sectors.

It has become a curiosity of the Fed’s current message that it is now looking to international factors in its timing decisions on a rate hike. The Fed’s Brainard was increasingly dovish on Monday…

There has been a lot of recent coverage and speculation on the direction of the price of oil and we are now seeing positive comment from some of the major brokers, agreeing that oil prices had…

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)