The longest day of the year has just passed. It is a pity that it coincided with some unwelcome news on inflation. Not only was the headline rate unchanged against expectations but, even worse was the fact that underlying inflation reached a peak not seen for more than 30 years. It now stands at over 7%. Little wonder that these numbers stimulated speculation on how the Bank of England’s Monetary Policy Committee would react, though the balance of opinion remained with a 25 basis point increase.

In fact the ‘hawks’ (i.e., those in favour of keeping interest rates higher to try to curb inflation) won the day and a rise of half a percentage point was announced, bringing interest rates to their highest point for 15 years. The result was to drive both the stock market and, more surprisingly, sterling into reverse. The pound had previously been a beneficiary of the belief that interest rates were likely to rise still further here, but clearly traders felt the news was now in the market and, anyway, this tightening by our central bank could have dire consequences for the economy.

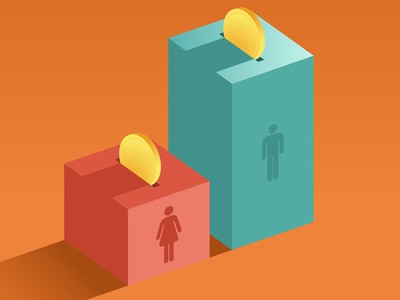

Wage rises pushing core inflation

Of course, the summer equinox is unlikely to have much influence on the behaviour of markets. The Bank of England’s decision on interest rates is another matter altogether. Recent robust employment numbers last week, which showed just how much wages are currently rising – hence the upward pressure on core inflation - gave support to the hawks who pushed the cost of money higher in an effort to choke off inflation. Only two ‘doves’ (those in favour of keeping interest rates low in order to generate economic growth) voted to keep rates unchanged, presumably because they were worried about the recessionary implications of tighter money.

How has the mortgage market been affected by higher interest rates?

Expectations are now that interest rates have still further to rise and will stay higher than expected for longer than we might have hoped. Certainly, the mortgage market has been adversely affected by these developments, which in turn has led to a cooling in the housing market. What we now have to watch for is a contraction in consumer spending as household budgets are squeezed. So far we have avoided a recession, but the worry now is that one could be inevitable.

As we move into the second half of the year, more news – both corporate and economic – will start to arrive and will doubtless affect market sentiment. Still, it is inflation and the likely level of interest rates that are likely to continue to dominate investment thinking. Roll on the summer holidays proper which we all hope will be unaffected by whatever is going on in the wider world. Frankly, we have quite enough to worry about here at home.