Bond focus

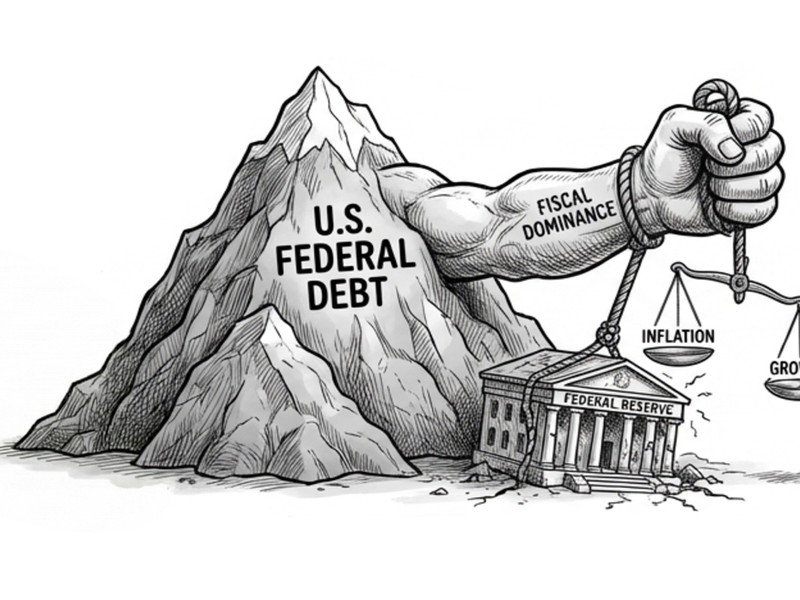

Jon Cunliffe explains how high levels of US government debt are pressuring the Federal Reserve to cut interest rates – creating an environment where investors increasingly favour shorter-dated US…

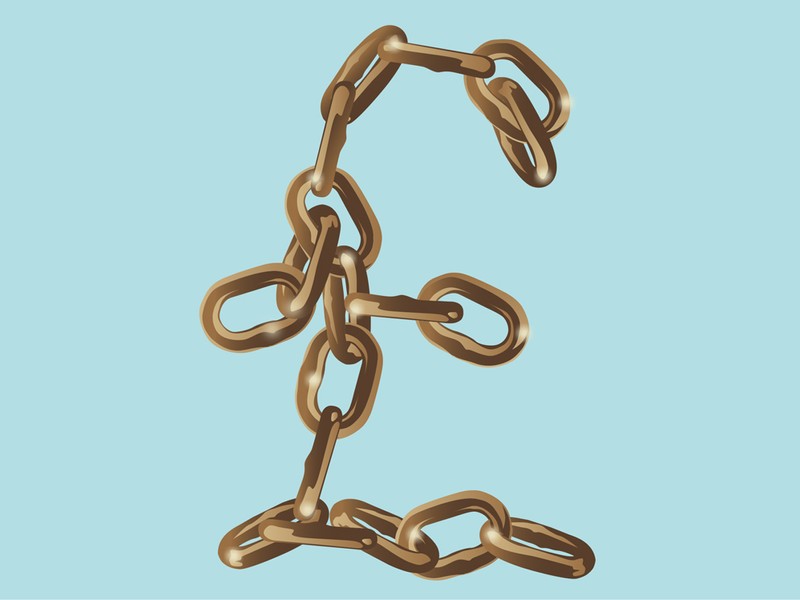

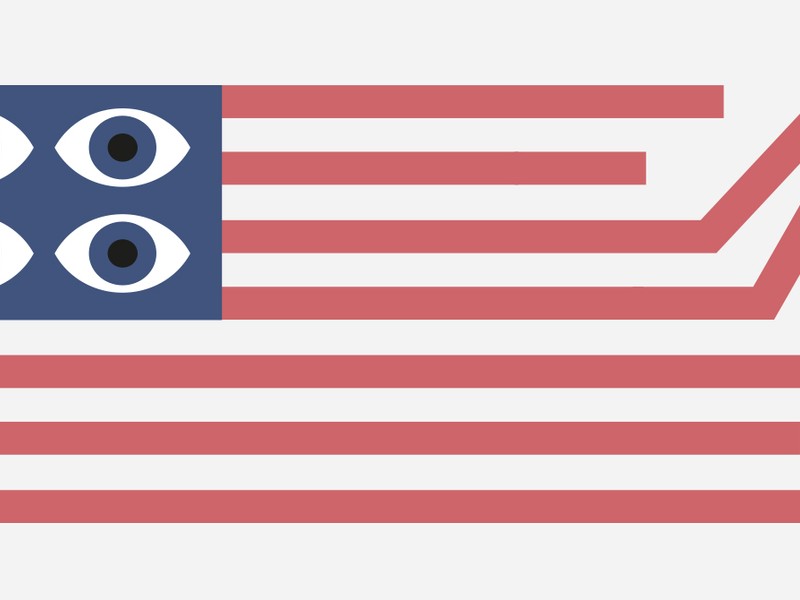

Sir John Royden explains how the threat of a Truss-style bond investor revolt is helping to keeping Trump’s erratic foreign policy in check.

This year’s fixed income outlook is finely balanced, with a high degree of uncertainty surrounding the impact of the incoming Trump administration’s policy agenda on growth, inflation, central bank…

Sir John Royden, Head of Research, explores the close link between bonds and interest rates in the UK and USA.

Henry Birt explores the perception of risk in investing, and the link between government bond yields and other asset classes.

The modified duration (“MD”) of a bond is a measure which describes the relationship between a bond’s price and interest rates.

Sir John Royden explains why, perhaps counterintuitively amid current high inflation rates, now may be an opportune time to invest in inflation-linked bonds.

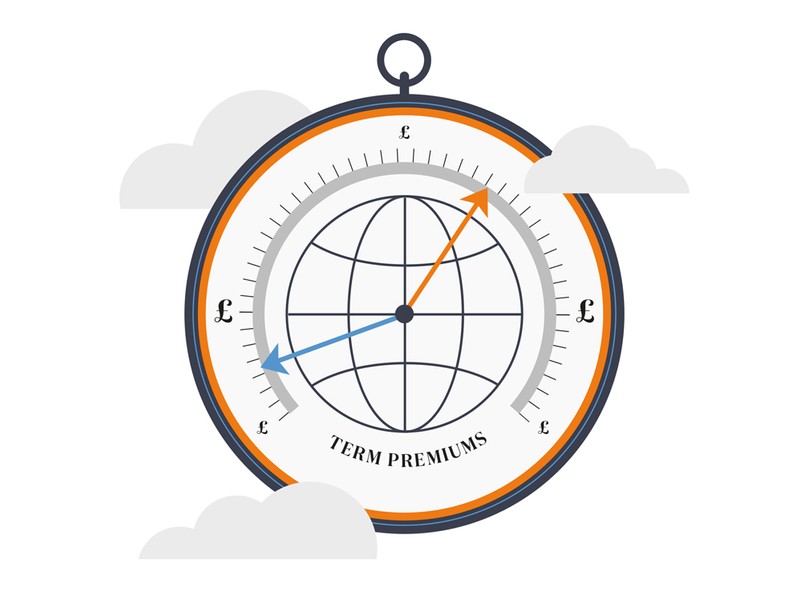

Sir John Royden explains ‘term premiums’ in bonds – and how the JM Finn research team use them as a barometer to spot potential opportunities in corporate and government bonds.

In the last edition of JM Finn Prospects (Summer 2023), Head of Research, Sir John Royden, discussed bond strategy, explaining how credit ratings split bonds into investment-grade and high-yield…

Sorting the wheat from the chaff: Sir John Royden, Head of Research, explains how bonds are rated and how they typically perform during recessions.

A question on all investors’ minds is what inflation is going to do? Head of Research, Sir John Royden sees economists divided into two camps.

Financial theory and countless financial textbooks outline how fixed income investments are traditionally considered, in aggregate, to be a lower risk asset class than equities.

Bonds have had a tumultuous, and for many, puzzling quarter. Head of Research, Sir John Royden tries to shed some light on this quandary for investors.

Media headlines are heating up with references to the current cost of living squeeze which is and will become an increasing economic reality.

If you like this article, follow us for more insights.

To receive more content like this subscribe today.

_1.jpg)

_1.jpg)