Our insights

Shaftesbury represents a unique cluster of London based retail assets, backed by extremely high management ability within this sector and locality. As the company highlights, this collection of…

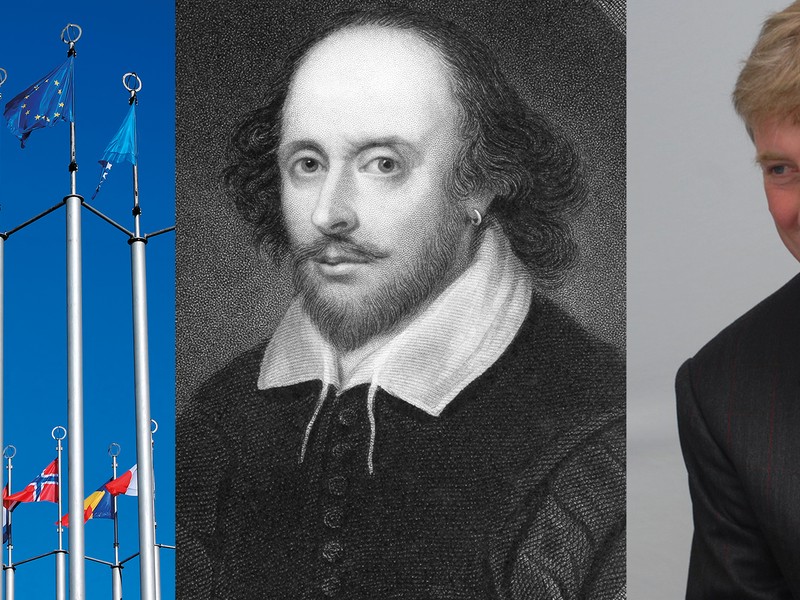

Some have compared this with the Thirty Years War that raged between Protestants and Catholics in Europe between 1618 and 1648 and which left Germany devastated.

I was asked recently whether we should just sell everything in light of the uncomfortable first quarter we’ve just experienced, but rather than shut the door after the horse has bolted, I’m always…

With a deal now sealed and the battle lines being drawn for June’s referendum, Europe looks like being the focus of attention for the foreseeable future.

Citywire Wealth Manager has revealed it’s shortlists for next month’s Regional All Stars Awards.

The Yorkshire rows have completed their race across the Atlantic, after just under 68 days of rowing.

Andy Haldane, Chief Economist of the Bank of England, has flagged the real possibility of a negative interest rate strat egy.

Sir Peter O’Sullevan CBE was the BBC’s leading horse racing commentator from 1947 to 1997.

Has the bear market finally come to an end? Shares have certainly rebounded recently, taking heart from a more buoyant mood in Asia.

This week’s two day summit on the EU-UK’s negotiations may see some leaders struggling to focus their minds.

Looking to identify the top 100 economic influencers in the region, the Suffolk 100 is returning in 2016.

J Sainsbury is a leading UK grocery chain. After a generation of growth in retail space, the UK grocery market is in excess supply and suffering a price war as ultra low cost competitors enter. J…

Prior to the last 15 years, this sector was incredibly opaque and retail banks were the only route to transacting one currency for another.

Howden is a well run cyclical company benefiting from a strong UK building market. Earnings have been growing well in excess of 10% for a number of successive quarters. 2014 was the best year for…

If you like this article, follow us for more insights.

To receive more content like this subscribe today.