More information goes here

Body

modal cta heading

Call to action

Call us on...

020 7600 1660Left column text

Middle column text

Right column text

Single Column (WYSIWYG) component

Text here...

Charles Bathurst-Norman reviews global investment landscape performance over the final quarter of 2025 – characterised by strong earnings in global stock markets despite ongoing geopolitical…

Andrew Mann addresses the social and economic importance of reducing youth unemployment.

Updates to reporting requirements under Automatic Exchange of Information (AEOI) regime – could your trust be affected?

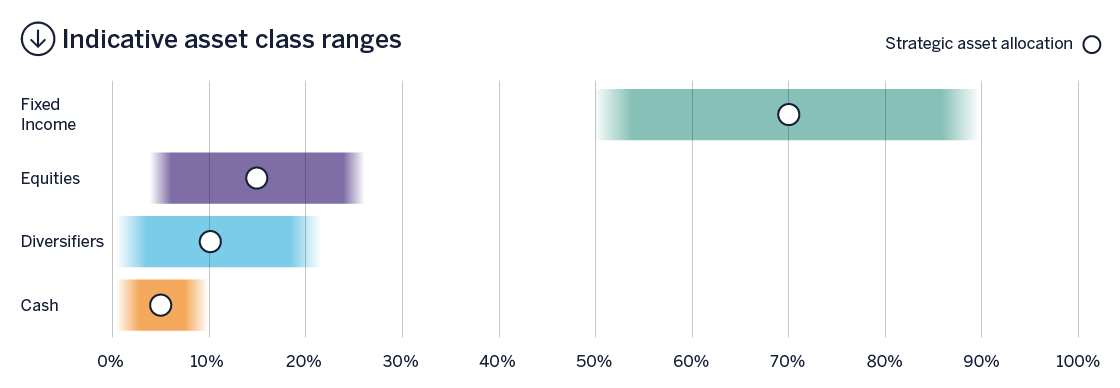

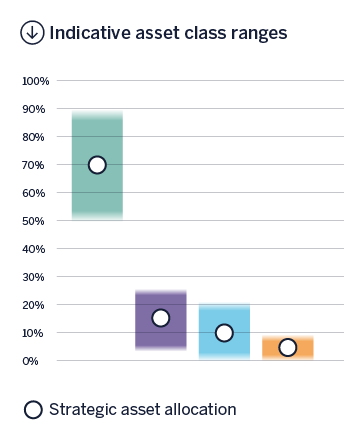

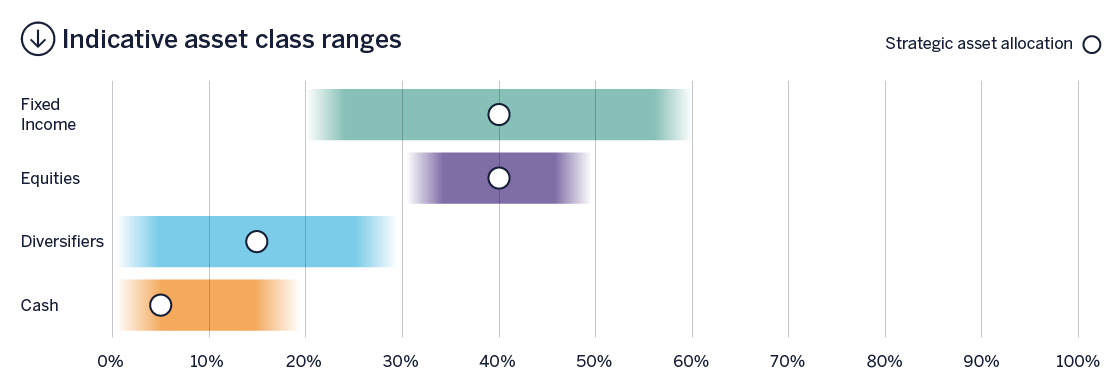

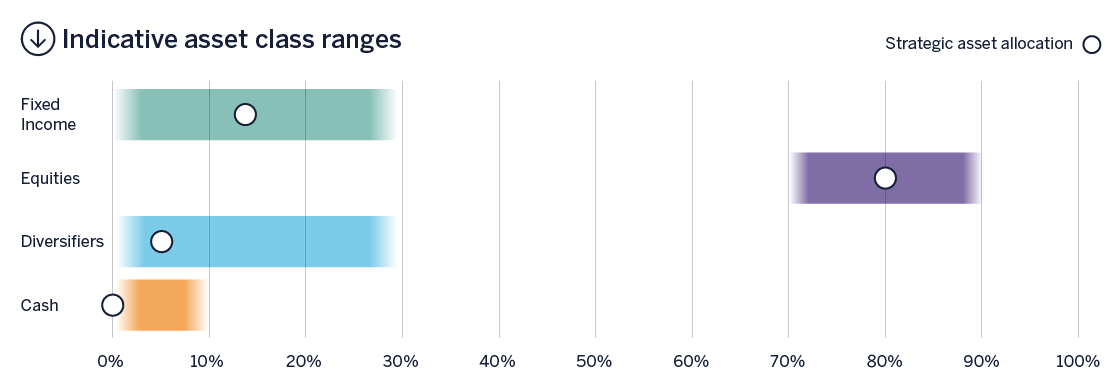

Cautious

This is our lowest risk strategy and may be suitable for an investor with a low risk tolerance looking to generate a return over time which exceeds the return available on cash deposits.

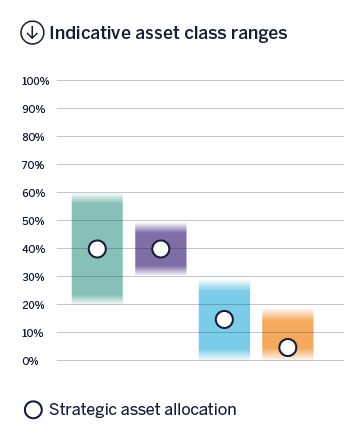

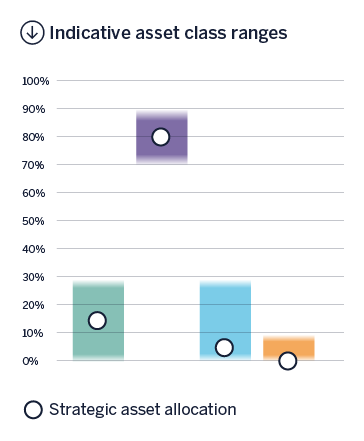

Conservative

With moderate exposure to equity investments this strategy represents low risk and can be suitable for investors looking for a return and willing to accept a degree of loss.

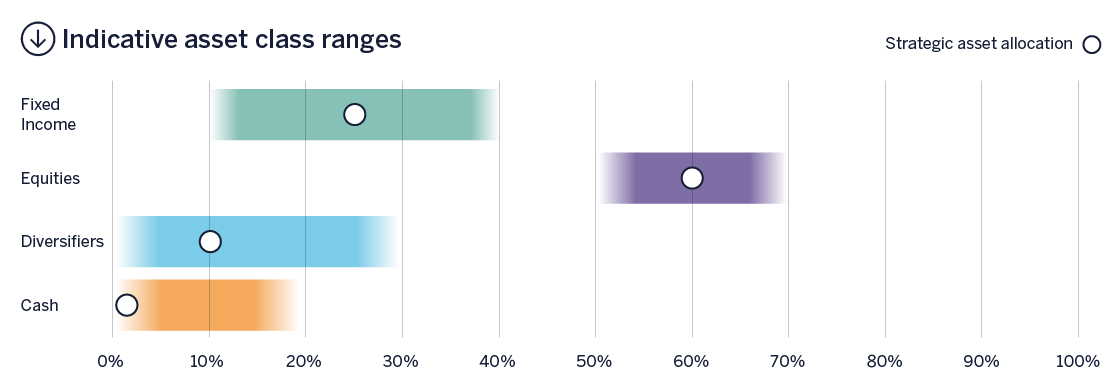

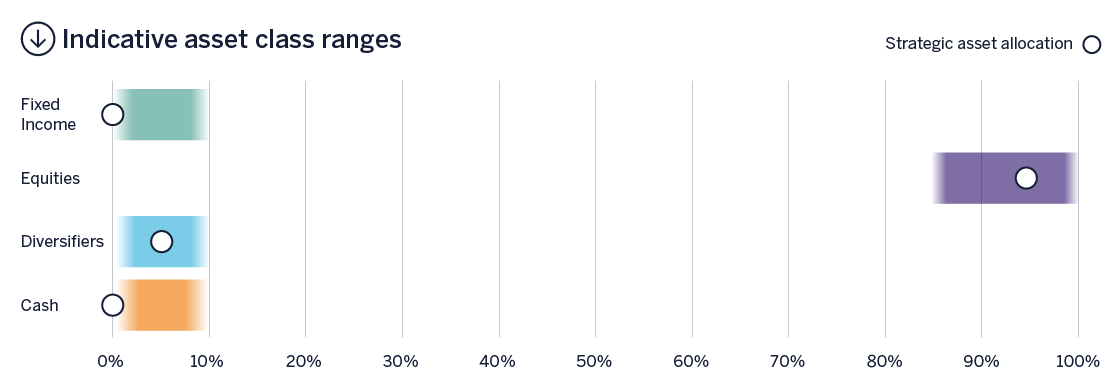

Moderate

A higher and significant exposure to equities offers the potential for greater returns but places a higher level of risk on the investment. Clients in this strategy must be able to accept at least a temporary loss of capital.

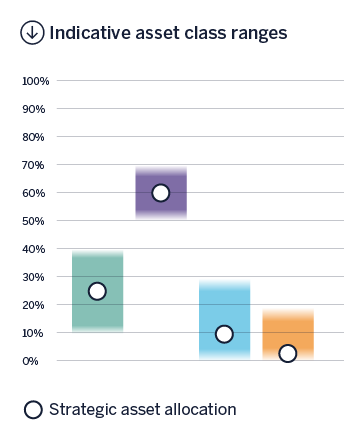

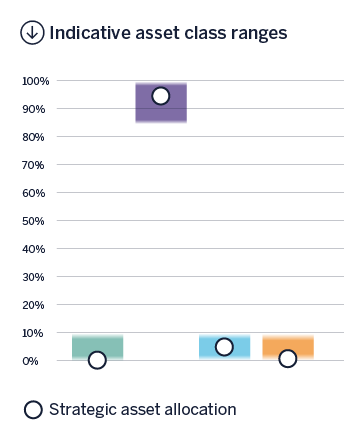

Progressive

With an anticipated 80% of the portfolio invested in equities, this might be suitable for those investors looking to grow their assets but able to tolerate a high risk of losing their capital.

Adventurous

This is the highest risk strategy, with almost all of the portfolio invested in equities. This can be suitable for long-term investors willing to accept a meaningful loss of capital in return for greater returns.