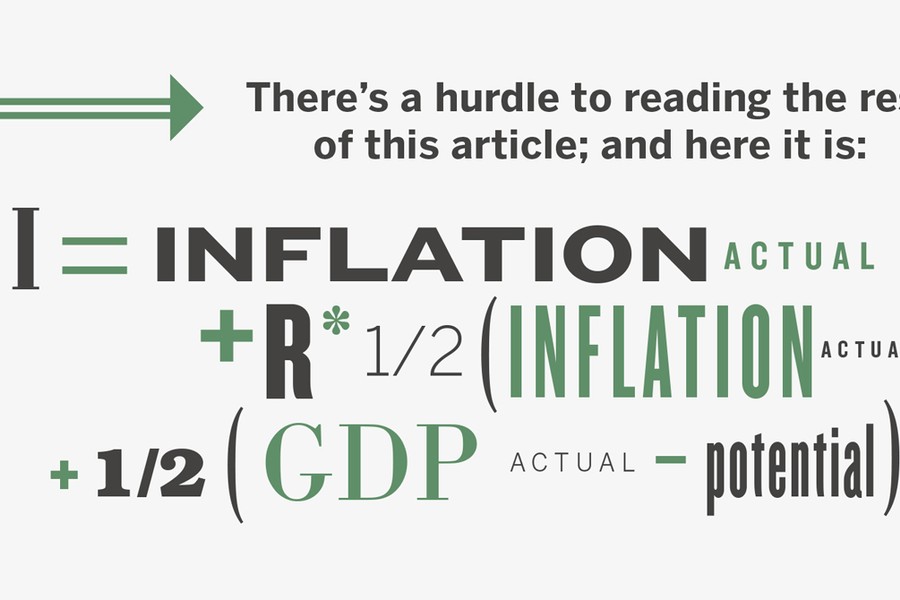

The formula says that when inflation is higher than it should be and when GDP growth is higher than it should be, then you need higher interest rates. The trick is knowing what R* (sometimes called “R Star”) is. We can only estimate this, but it is meant to be the real interest rate which keeps inflation at 2% and the optimum number of people in work.

We need to know about and apply the Taylor Rule because it is what the Central Banks talk about, which subsequently affects what interest rates are and where they should be going.

What is interesting is that when you look at the major economies of the US, UK, mainland Europe and Japan, you find that the Taylor Rule says that interest rates should be much higher than they actually are. In America interest rates are 2% lower than they should be. In the UK, the gap is 3%. The outliers are Sweden and Germany where the gap is closer to 5%. That is one of the reasons why I think you should keep a short duration bond exposure. A short duration bond exposure means holding bonds likely to mature in the next five years or so; shorter dated bonds are less sensitive to movements in interest rates.

There is always an uncomfortable compromise between accepting the very low yields of bonds with two or so years to run with the desire to be short dated. Any bond that sits within the one to five year life to maturity fits the bill as far as I am concerned.

I have lots of other reasons to want to be short dated. The surge of populist influence on government augurs for higher budget deficits which are inflationary. Quantitative easing (QE) is being reversed in the US and has recently stopped in Europe. We have had the US stimulating its economy into a tight labour market which usually drives wage inflation and then actual CPI inflation higher. I expect oil to bounce back to $80 on Saudi Arabia and Russia cutting supply by 1.2 million barrels per day and Venezuela getting worse before it gets better.

The big question is whether China stimulates to reverse out of its slowing growth as China is, by most yardsticks, quite leveraged so the only real way for it to generate economic growth is with a fiscal stimulus. This probably means more infrastructure spending and maybe lower taxes, rather than lower interest rates.

Watch for global inflation to surprise on the upside as we move into the second half of 2019.

_1.jpg)