In the Summer Budget, the Chancellor announced the biggest shake up of the taxation of dividends since 1999 to take effect from 6 April 2016. This article explores these expected changes and their potential effects on individual investors.

Although the intricacies of this major reform remain unclear – we must await the autumn statement for further detail – it is possible to provide some advance comment as to what the effects will be for investors.

CURRENT RULES

At present, to the extent that an individual is liable only to the basic rate of tax (20%), no income tax is payable on dividends received.

For a higher rate (40%) taxpayer, dividends received are taxed at 25% and for additional rate (45%) taxpayers, the rate is 30.56%.

POSITION FROM 6 APRIL 2016

These rates all change with effect from 6 April 2016. From that date, the first £5,000 of dividend income will be income tax exempt. Beyond that amount;

- a basic rate tax payer will pay tax at 7.5% on dividend income;

- a higher rate tax payer will pay 32.5% tax; and

- additional rate tax payers will pay 38.1% tax.

IMPACT OF THE PROPOSED CHANGES

It is anticipated that some investors will be better off while others will see their tax bills rise.

A basic rate paying investor with less than £5,000 dividend income will not see any change to their tax position, while those liable to a higher rate will be better off.

Once the £5,000 limit has been breached, basic rate taxpayers are immediately worse off by 7.5% tax on the excess, while those liable to a higher rate effectively see the benefit of the £5,000 exemption unwind until a point is reached that more tax is payable.

THE FOLLOWING EXAMPLES ILLUSTRATE THE ISSUES.

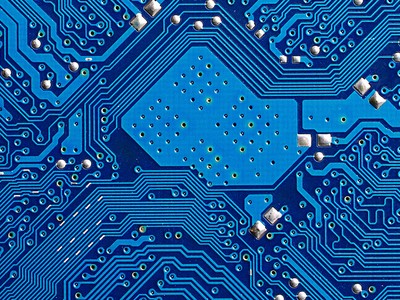

Example one: basic rate taxpayer A basic rate taxpayer receiving £15,000 of dividends, will pay an additional £750 tax.

Example one: basic rate taxpayer A basic rate taxpayer receiving £15,000 of dividends, will pay an additional £750 tax.

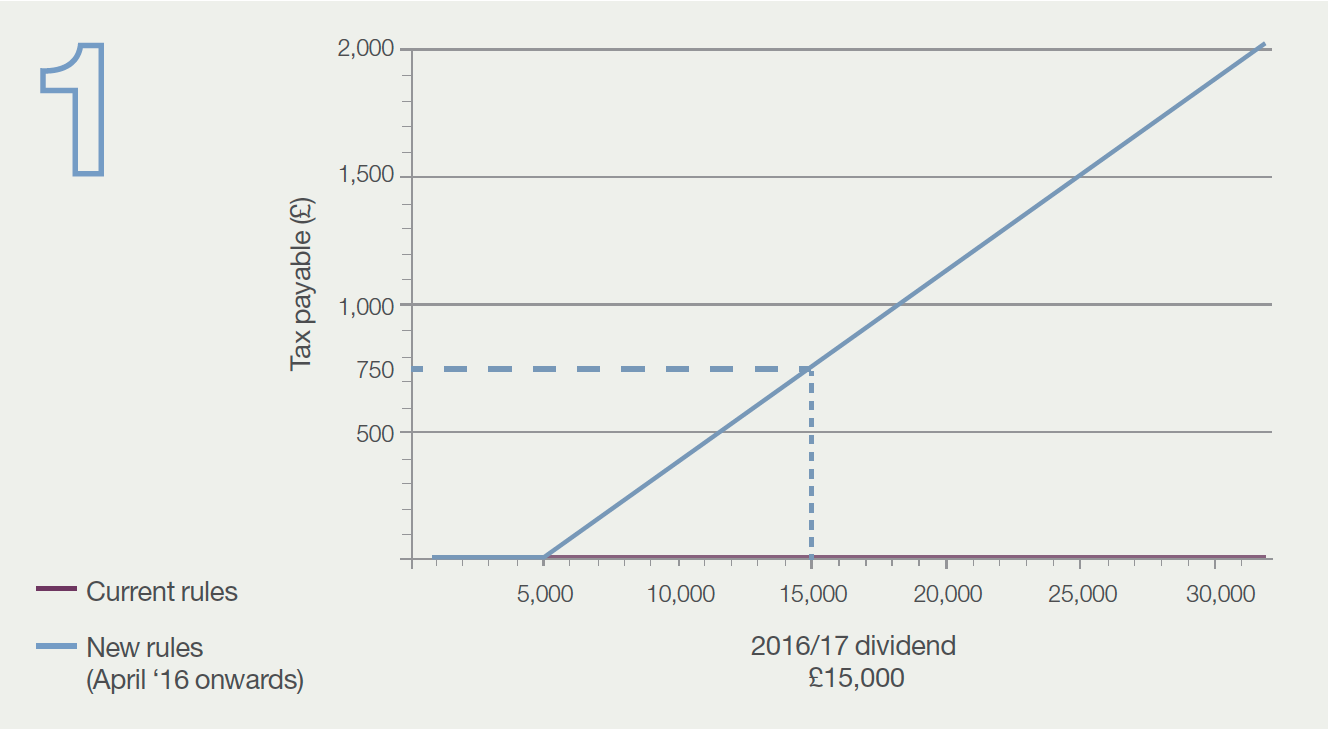

Example two: higher rate taxpayers liable to 40% income tax.

A higher rate (40%) basic rate taxpayer receiving £15,000 of dividends, will be £500 better off.

On the other hand, a 40% tax payer, with over £21,000 of dividends will be worse off under the new rules so that dividends of £29,000 for example will give rise to additional income tax of £550.

For 45% taxpayers, a similar picture emerges: Those investors receiving £15,000 of dividends will result in a saving of £774 tax; conversely, those receiving £29,000 of dividend as a higher rate tax payer will result in additional tax of £283.

CONCLUSIONS

The changes, if implemented as currently anticipated, may lead to more people considering investments with an emphasis on a total return basis by including investments aimed at achieving capital growth, rather than income. This will allow investors to make use of the capital gains tax annual exemptions if these are not already routinely used.

Other options which might be considered from a tax planning point of view, but which must be subject to non-tax considerations, not least investment criteria, include:

- Transferring shareholdings to a spouse

- Making full use of annual ISA investment allowances

- Investing in Venture Capital Trusts

- Using offshore bonds as a holding vehicle

It is critical that any portfolio changes to mitigate the effect of the new rules must only be undertaken after proper consideration of all relevant factors, not least the potential capital gains tax cost of making portfolio changes in order to save income tax.

Further announcements need to be awaited before specific individual tax and investment advice can be given, but what seems clear at this stage is that no one single approach will be suitable for everybody.

Stephen Barratt is a director in the Private Client Team at James Cowper Kreston in their Newbury and Oxford offices.

James Cowper Kreston

Mill House, Overbridge Square

Hambridge Lane,

Newbury RG14 5UX

Tel: +44 (0)1635 35255

E: info@jamescowperkreston.co.uk

JM Finn & Co is not able to give individual advice regarding taxation. Clients who wish to explore the possibilities that this article opens up should seek advice from a tax specialist in relation to their own personal circumstances.