Individual Savings Accounts (ISA)

With interest rates still low, inflation and taxation present very tangible risks to the real value of savings. Particularly with inflation (CPI) currently still sitting at less than 1%.

ISAs are a tax efficient vehicle in which the owner pays no income tax on the income received from their ISA savings. The ISA does not attract capital gains tax arising on the investment gains either. The table below highlights the strength of ISAs in shielding wealth from the impact of tax and inflation.

Equivalent Gross savings rate needed to equal the rate of inflation…

| Inflation Rate | ISA | Basic Rate Taxpayer | Higher Rate Taxpayer | Additional Rate Taxpayer |

|---|---|---|---|---|

| 2.00% | 2.00% | 2.50% | 3.33% | 3.64% |

| 2.50% | 2.50% | 3.13% | 4.17% | 4.55% |

| 3.00% | 3.00% | 3.75% | 5.00% | 5.45% |

| 3.50% | 3.50% | 4.38% | 5.84% | 6.35% |

The individual allowance for the new tax year remains at £20,000 for adults with the Junior ISA allowance at £9,000 and available for anyone under the age of 18.

An interesting quirk in the current legislation is that 16 and 17 year old children currently have access to two ISA allowances, £9,000 for a Junior ISA in addition to £20,000 for an adult cash ISA. Consideration may also be given to converting a Child Trust Fund into a Junior ISA, permitted since April 2015.

There is also the Lifetime ISA (LISA) to consider for those between the ages of 18 and 39. The annual allowance for this is £4,000 up to the age of 50. This counts towards your existing annual ISA limit. The government will add an annual 25% bonus to your savings, up to a maximum of £1,000 pa. This can then be used towards buying your first home, or for funding retirement when 60 or over. Beware however if you are aged under 60 there’s a 25% charge to withdraw cash from the Lifetime ISA if this is not for buying your first home.

Contact JM Finn to discuss the ISA contributions that you have made in the current tax year, remembering that individual ISA allowances do not carry forward!

Marriage Allowance

In the UK the standard personal allowance for an individual is £12,570 (21/22). This is the amount of income on which you do not have to pay income tax.

However, if you have a husband/wife/ civil partner who is on an income level below £12,570 you can apply to transfer £1,257 of their personal allowance to yourself. This is provided your income level is between £12,571 and £50,270. This will reduce your tax bill by up to £252 in the tax year. You can backdate your claim by four tax years to include any tax year since 5 April 2017 that you were eligible for Marriage Allowance.

Capital Gains Tax (CGT)

CGT is a tax levied on the profit when you 'dispose of' an asset that realises a gain. The gain you make is then taxed, rather than the amount of money received. The individual tax-free capital gains allowance, known as the ‘annual exempt amount’, is currently £12,300 (21/22) and will remain at this rate until 25/26.

Where sensible, the annual capital gains allowance should be fully utilised each tax year as failure to do so will result in the benefit being lost. Regular and proactive capital gains tax management will serve to reduce the impact of taxation on wealth accumulation/preservation. Effective use of the allowance could reduce your tax liability by up to £2,460[1].

Consideration may also be given to realising gains on assets and transferring them to a lower or non-taxpayer or tax effective investment, such as an ISA. This can be particularly effective with the use of inter-spousal transfers. Inter-spousal transfers (also applicable to civil partners) refers to gifts between partners for which no CGT charge generally occur. This effectively allows individuals within partnerships to utilise two tax-free allowances flexibly between one another.

It is also possible that losses on capital assets may be realised/carried forward in order to offset any taxable capital gains that were realised in the current tax year.

Pension Contributions

The tax incentives and efficiencies offered by pensions make them a particularly attractive means of accumulating wealth for retirement.

You can pay into pension up to 100% of your pensionable earnings and receive tax relief, capped at the annual allowance of £40,000. Restrictions apply to individuals with income of more than £240,000[2]. Where you have no income it is still possible to contribute £3,600 towards a pension.

New pension freedom rules have provided investors with greater access, flexibility and control over their pension savings. Key benefits of making additional pension savings before the end of the tax year:

- Boost retirement savings within a highly tax efficient investment vehicle.

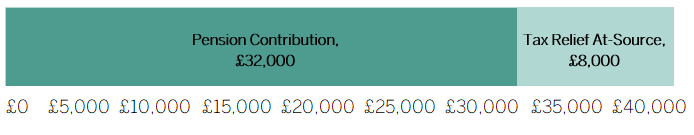

- Access pension tax relief of 20%. For example, if you contribute £32,000 (subject to allowances), the government will top up the contribution by a further £8,000 (making your total contribution £40,000).

- Reduce your tax liability. Contributions made by higher rate (HRT) and additional rate (ART) taxpayers may attract additional tax relief of 20% and 25% respectively.

- Reclaim allowances. The standard tax free personal income allowance of £12,570 is reduced for incomes over £100,000 (cutting out altogether at £125,140). Pension contributions can be used to reduce an individual's taxable income and reinstate the personal allowance, providing tax relief of up to 60% on the contributions made.

- Contributions can also be made for non-working family members, such as a spouse, child or grandchild. If a contribution of up to £2,880 is made, the government will contribute a further £720, by way of pension tax relief. For example, annual pension contributions of £2,880 per year for a child until their 21st birthday could result in a pension benefit of £339,000[3] when they reach age 68. This benefit would come at a total cost of £63,360.

Gifting to charity

Much like contributing towards pensions, gifts to charity also attract relief from certain taxes such as income tax. This is done primarily via Gift Aid or Payroll Giving.

Gift Aid is a scheme run by the government in which any charity you donate to can claim a further 25p from the taxman for every £1 donated. These donations also have the effect of increasing your basic rate band and higher rate income tax bands by the grossed-up amount of your gifts. So, if you are a higher or additional rate tax payer, you can claim the difference between the higher and basic rate on your donation on your Self-Assessment tax return. Alternatively, you can ask HMRC to amend your tax code.

Example:

If your Gift Aid payments add up to £100 in 2021 to 2022 the grossed-up value of your donation to charity would be £100 × 100/80 = £125. Higher rate relief due to you would be:

- £25 if you pay tax at 40% (£125 at 20%)

- £31.25 if you pay tax at 45% (£125 at 20% plus £125 at 5%)

Payroll giving can be done through some employers or personal pension providers. This allows you to donate straight from your wages or pension towards a charity before income tax is deducted. The tax relief you get depends on the rate of tax you pay. If donating £1, you would pay:

- 80p if you are a lower rate taxpayer

- 60p if you are a higher rate taxpayer

- 55p if you are an additional rate taxpayer

Additionally, the effect of gifting could have implications for your various allowances in the same way as for pension contributions.

It is important that you keep records of all of your donations if you wish to deduct them from your total taxable income.

Inheritance Tax Planning (IHT)

IHT is an unpopular tax levied on the intergenerational transfer of wealth subject to various available reliefs.

IHT is payable at a flat rate of 40% (reduced to 36% if you leave at least 10% of your net estate to charity) on estate assets in excess of £325,000 (known as the nil rate band) for a single person or £650,000 for a couple[4].

Small gifts made out of normal income do not generally attract Inheritance Tax. These are known as ‘exempted gifts’.

There may be Inheritance Tax to pay if you’ve given away more than £325,000, but only if you die within seven (7) years. Even after three (3) years tapered relief exists to reduce the tax liability on the gifted asset.

Whilst the ‘exempted gift’ threshold is considered by many as insignificant, it can be used as an effective means of saving/investment for grandchildren via contributions to Junior ISAs.

There is an additional main residence allowance of £175,000 per individual, introduced in the 2017/18 tax year, for main residences passed on to direct descendants[5].

Individuals can give away £3,000 worth of gifts before the following tax year without them being added to the value of your estate. If you haven’t used your annual exemption from last tax year, you can carry it forward and use it this year.

Tax Year End Checklist (where appropriate):

- Maximised pension contributions for you and your spouse

- Utilised Individual Savings Account (ISA) allowances

- Optimised management of Capital Gains Tax liabilities

- Implemented proactive Inheritance Tax (IHT) planning measures

Anna Murdock, Head of Wealth Planning

To learn more about how our wealth planning services might be able to help you, please contact us here.

Contact JM Finn to discuss the ISA contributions that you have made in the current tax year, remembering that individual ISA allowances do not carry forward!

The information provided in this article is of a general nature. It is not a substitute for specific advice with regard to your own circumstances.

[1] Based on £12,300 of assessable gains at rates of up to 20% (applicable to higher or additional rate taxpayers on investment gains).

[2] For individuals with ‘threshold income’ in excess of £200,000 and ‘adjusted income’ in excess of £240,000, your annual allowance will be reduce by £1 for every £2 above £240,000. The maximum reduction is limited to £36,000.

[3] Based on a growth rate of 8.00% per annum and price inflation of 4.5% per annum – as set down by the Financial Conduct Authority for pension projections. Ongoing fees have been assumed at 1.00% per annum.

[4] This assumes that none of the nil-rate band is utilised on first death event through use of inter-spousal transfer exemption. Where this is used the surviving partner will inherit the remaining proportion of the nil-rate band. The maximum nil-rate band an individual may be entitled to is two times nil-rate band. This inheritability also applies to the residence nil-rate band subject to conditions

[5] There will be a tapered withdrawal of the additional nil-rate band for estates with a net value of more than £2 million. This will be at a withdrawal rate of £1 for every £2 over this threshold.