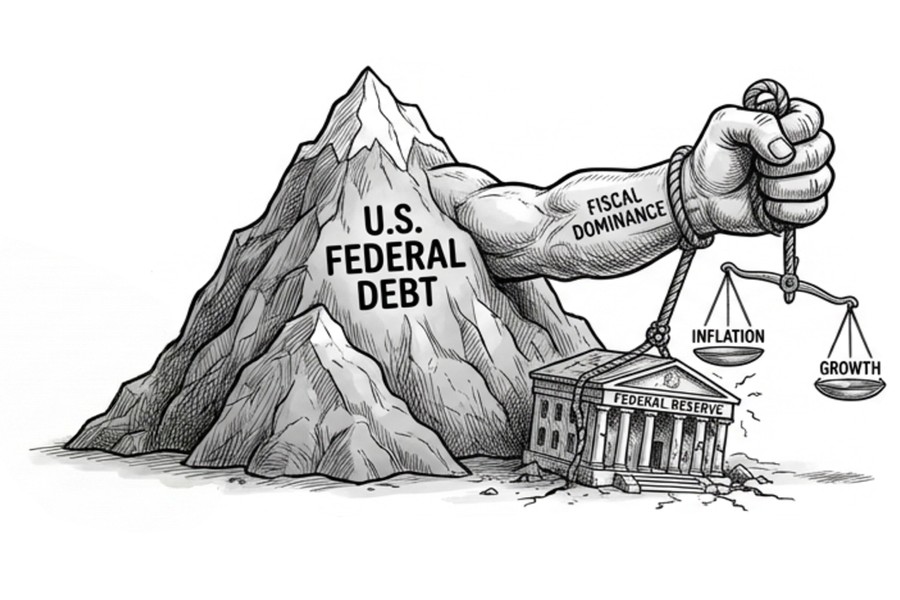

The US government bond market is entering a new phase, and 2026 could prove a pivotal year. One of the biggest forces shaping the outlook is fiscal dominance – an environment where the government’s debt and spending begin to influence central bank decisions more than traditional goals like controlling inflation and fostering growth. This shift could have major consequences for investors, especially those holding US Treasuries.

US debt could rise to 145% of GDP within the next decade.

Fiscal dominance occurs when the government’s debt becomes so large that the central bank feels compelled to keep interest rates low or buy government bonds to help manage the burden. In the US, the risks of this are becoming more visible. The Congressional Budget Office expects interest payments on federal debt to exceed $1 trillion for this year, making it the second-largest category of federal spending and accounting for more than 20% of government revenue. A key driver of this is the Trump administration’s decision to make the 2017 framework for income taxes and incentives to boost investment in research and infrastructure permanent. Estimates of their impact on the national debt vary, but even allowing for revenue from tariffs on US imports (the cornerstone of US trade policy), debt could rise to 145% of GDP within the next decade.

This environment is already affecting the bond market. Investors have been demanding higher additional yield to hold long-term Treasuries relative to shorter-term bonds. There’s also growing concern that political pressure could influence the Federal Reserve to cut rates for reasons unrelated to economic fundamentals. If rate decisions are seen as politically motivated, it could bring an undesirable sell-off in bonds which could bring negative consequences, both for the broad economy and the equity markets.

Against this background, the US Treasury has been increasing the amount of short-term debt it has been issuing, with Treasury bills (short maturity bonds) now making up 21% of all outstanding US government debt – a historically high level. These shorter-term instruments help the government manage interest costs more flexibly, but they also increase the risk of having to refinance at higher rates in the future. At the same time, long maturity bonds are falling out of favour due to their higher price sensitivity to rising yields. There’s also a noticeable shift toward inflation-protected bonds and gold, as investors look for ways to safeguard their portfolios against inflation and potential US dollar weakness.

If rate decisions are seen as politically motivated, it could trigger an undesirable sell-off in bonds.

This shift in the US has implications beyond its borders. In the UK, the Gilt market is not immune to these pressures. With the US Treasury market effectively the benchmark for risk-free interest rates, rising US yields tend to push global rates higher, and long-dated UK Gilts have experienced elevated volatility as investors respond to inflation risks and fiscal sustainability. With the UK’s own debt levels elevated, the Bank of England may also face growing tension between supporting growth and maintaining credibility on inflation. If fiscal pressures mount, the UK could see a similar tilt toward shorter-duration issuance and a greater reliance on domestic investors, potentially raising rollover risks.

Looking ahead, both the US and UK government bond markets are likely to remain volatile, with the current level of long-term yields reflecting elevated borrowing and above target inflation. For investors, the key is to stay flexible. Strategies that focus on effective management of the maturity of bonds held, what proportion of inflation protected bonds to hold, and the ability to adapt to changing interest rates will be crucial. While the path forward may be uncertain, thoughtful positioning, favouring short-dated and intermediate maturity bonds – which stand to benefit the most from lower central bank policy rates – should reward the patient investor with returns which exceed those available from cash deposits.

Please read the important notice on page 1.