Before I proceed I must admit that 1) I am from the self-righteous millennial generation; 2) I probably do follow the irritatingly named ‘flexitarian’ diet and 3) I have had a flat white with oat milk this morning.

I appreciate that’s not the most enticing opening line to an article about the meat and dairy substitute markets, but fear not, this is no preachy pitch aimed at converting carnivores into Quorn consumers. I aim to provide an overview of the business of plant-based food and beverages, which as categories are some of the fastest growing in the industry. Although currently more of a Western focus at present, the global meat substitute market is estimated to be worth $4.3B (2018) and is expected to nearly double to $8.2B by 2026. Whilst the dairy alternatives market is expected to nearly triple from $13B (2018) to $35B by 2026, driven not only by the demand for vegan products in the West, but also because of its popularity in Asia due to the prevalence of dairy intolerances.

In the UK, contrary to popular thinking, growth in plant- based consumption is being driven primarily by the rise of the flexitarian consumer – individuals who eat meat and dairy but seek to reduce the levels they consume - not from the increased numbers of vegans (c.1% of the population) – individuals that follow only a plant-based diet - and vegetarians (c.2%) – individuals that do not eat meat or fish.

Meat alternatives come in the form of soy, pea, pulses, seitan and tempeh, which can be temperature treated and combined with flavourings to closely replicate the taste of meat. Replacements for dairy include the likes of milk from oats, coconut, nuts and rice. It is important to note that I am highly sceptical that a good Époisses cheese can ever be replicated.

Much of the motivation that underpins the rise of plant-based food and drink comes from the increased awareness of the impact that the meat and dairy industries have on the environment, animal welfare and our health. Such concerns have accelerated more recently given increased media coverage, with documentaries such as Netflix’s The Game Changer being watched by a global audience. No longer just for a niche consumer, plant-based meat and dairy alternatives have gone mainstream.

No longer just for a niche consumer, plant-based meat and dairy alternatives have gone mainstream.

Having enjoyed relatively stable conditions for decades, with only minimal incremental innovation being made, the global food and beverage industry now faces unprecedented levels of competition from start-ups and disruptors that are launching new and exciting products to meet the increasing demand for innovative plant-based foods. In 2019, nearly a quarter of all new food product launches in the UK were vegan.

Such businesses have been scrambling to simultaneously defend their existing market shares and innovate in an effort to capitalise on the growing opportunity. This is impacting not just food and drink producers. Pubs and restaurants are creating separate vegan menus, fast food outlets are introducing vegan menu items and supermarkets are not only increasing their shelf space for vegan products but are also now positioning them next to meat and dairy products, widening their potential consumer appeal. When bastions of normality such as Wetherspoons and KFC start releasing their takes on meat free burgers, you know times have changed.

Switching focus to publically listed food and beverage manufacturers, strategies to defend and/or exploit the rise of plant power vary, depending on market positioning.

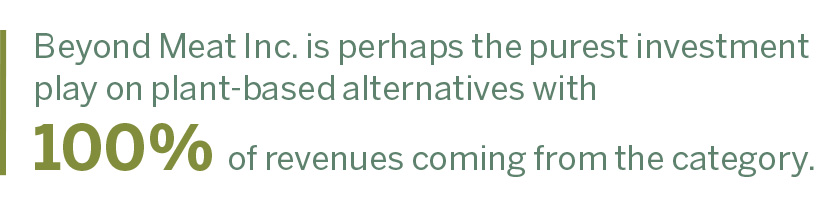

Beyond Meat Inc. is perhaps the purest investment play on plant-based alternatives with 100% of revenues coming from the category. Established in 2009, it has been one of the key innovators and developers of meat-free products that aim to resemble actual meat. Its maiden product, the Beyond Burger, is considered to have the texture of a beef burger, developed through the use of pea protein which are extracted via a water-based process. Meanwhile its taste has been attained through the use of genetically modified yeast which produces heme, the molecule that occurs naturally in red meat. In my opinion, it actually tastes quite nice; whether it’s healthier than a meat burger is however questionable.

Beyond Meat has bought out a number of products including Beyond Beef, Beyond Sausages and in collaboration with KFC, is currently trialling Beyond Chicken. High innovation in an already nascent industry is supercharging growth for the business – its revenues are expected to jump by over +300% for FY19. This is however from a low base of $88M in FY18 and the business is still expected to make a net income loss of -$11M for FY19. With an estimated 1% market share of just the plant-based food category, Beyond Meat is but a drop in the ocean in the context of the $946B (2018) global meat industry. With this in mind, along with the interesting viewing of its share price performance since its public listing in May 2019, Beyond Meat is clearly a business with a very high risk/return profile.

The behemoths of the food and beverage world such as Danone ($29B of revenue FY18), Nestle ($93B) and Unilever ($58B) have taken a different approach. The scale of these businesses, along with the benign competitive pressures they have faced historically, means that they lack the ability to innovate as quickly as small start-up disruptors. What they lack in innovation, however, they make up for in financial strength and geographical reach. Their strategy has been to acquire innovative plant-based start-ups and integrate them into their existing distribution networks in an effort to quickly gain market share. Examples of which include Danone’s acquisition of Alpro - the world’s leading plant-based alternative producer - through its $12.5B purchase of Whitewave in 2017, Unilever’s 2018 acquisition of the Vegetarian Butcher, a Dutch producer of plant-based meat substitute products and Nestle’s acquisition of US based Sweet Earth, a producer of an array of plant-based products which include frozen meals.

The plant-based food and drink market is a growing pie which everyone wants a piece of.

These large businesses are certainly safer investment plays on plant-based foods, but with Danone having the highest exposure of the three to plant-based foods (c.6% of revenues), they do offer limited exposure to the theme.

Somewhere between the start-ups and the behemoths of the food and industry world are the flavouring and ingredients companies, like Givaudan ($5.6B of revenues FY18) and Kerry Group ($7.8B). These businesses have supplied the big food and drink manufacturers for decades and have niftily been able to jump on the plant-based bandwagon by developing their own plant-based ingredients, and by acquiring small niche business and integrating them into their offering.

Such flavour and ingredient products include:

- natural stocks that rehydrate plant proteins with an umami taste

- yeast extracts that add succulence, juiciness, richness and body to plant-based foods

- and ‘coating systems’ that enhance texture and appearance to optimise ‘the taste experience’.

You can even get ingredients that add smoke and grill taste profiles. Vegan doesn’t always mean non-processed.

Such unique and innovative companies do however attract premium valuations with one year, forward price- to-earning valuations of 34X and 27X respectively for Givaudan and Kerry Group.

The plant-based food and drink market is a growing pie which everyone wants a piece of. Yet despite the rise in the availability of such products, the industry is still in the early stages of its lifecycle. New product innovations and rising consumer demand still offer significant growth runway for the category. Whether this is a market that becomes commoditised overtime and, whether any company is able to reap significant financial rewards as the market develops, is up for debate. After all, how differentiated are existing mainstream meat and dairy products?

Illustration by Abby Humphries