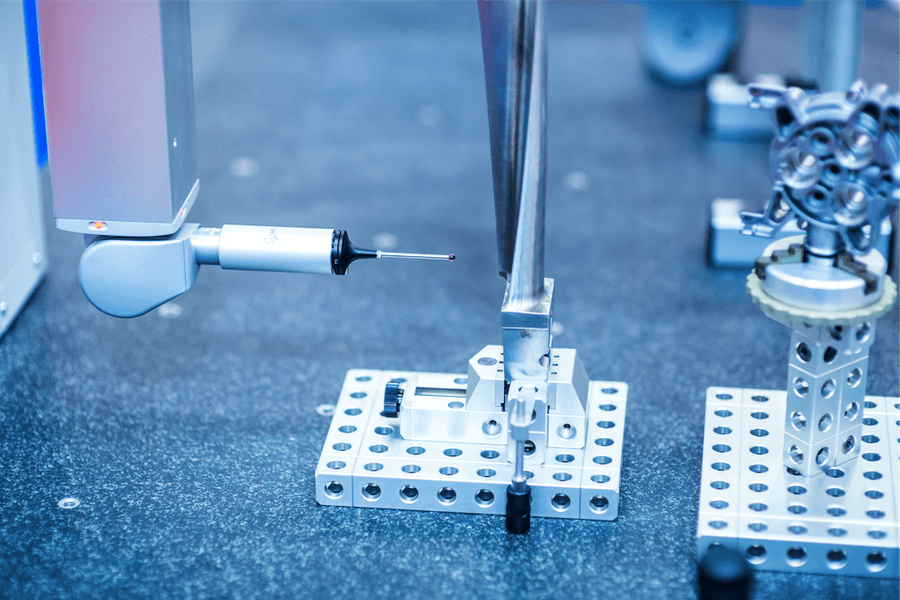

Renishaw aren’t your average FTSE250 Industrial. In 2013, a decision was made that investors would only get to see management twice a year; once at the AGM and once at an investor day, which we recently attended. When asked how many of their Neuromate robots, designed to complete neurosurgical procedures, have been sold, they would not tell us. If we ask for the price of one of their additive manufacturing machines used for metal 3D printing, they won’t tell us.

Whilst for some people this opacity would be a reason to sell their shares in Renishaw, it could very well be argued that it is precisely this structure that has helped Renishaw to become the c. £3.5bn market cap global leader that it is today.

Renishaw is managed for the long term interests of its patient shareholders, not the short term whims of some parts of the capital markets.

The driver of this has been 78 year old founder and Executive Chairman, Sir David McMurtry, who still owns 36% of the share capital. Although McMurtry has recently handed over the role of Chief Executive to William Lee, his core beliefs for long term investment and passion for invention we hope will endure.

Research & Development at a greater rate than any of their listed peers has been a key feature of this long term strategy and whilst McMurtry is no longer officially at the helm, he appeared quick to interject when the question was asked at the investor day about R&D spend going forward; “I’d hate to see it drop off”, he told William Lee.