Over the coming weeks, the research team will be releasing a series of updates on how we view the pandemic developing and our view of the market’s reaction and the government policy response.

At this exceptionally challenging time, we would like to take this as an opportunity to thank the extraordinary efforts made by healthcare professionals, carers, volunteers, the public services and, those working in other essential sub-sectors of the UK and global economy to combat and mitigate the effects of this Coronavirus pandemic.

An update on the Coronavirus outbreak

The coronavirus pandemic has quickly shifted from an initial supply chain disruption into a global supply and demand shock that is and will continue to reverberate across asset classes and throughout all economic sectors over the coming months at the very least. Increasingly governments around the world have enacted ever more stringent lock-downs as governments aim to slow the rate of new infections to reduce the peak in active Coronavirus cases. It is hoped this strategy will reduce the extreme pressures being placed upon healthcare systems globally, create more time for ventilators to be manufactured and delivered to those patients most in need – to ultimately drive higher recovery rates from the growing number of Coronavirus infections and ‘flatten the curve’ of infection rates.

It is now increasingly clear that the global economy will fall into a recession but the severity and length of this recession remains largely undetermined. The financial and economic impacts will principally depend upon how effective governments are at managing the spread of the virus and the approaches taken, to ease social distancing measures over time.

Coronavirus – a look at the latest data

When we last wrote on the 12th March 2020, Coronavirus cases had just risen above 116,000 and, 70% of confirmed cases were within China. However, the situation has changed meaningfully since. This is, in part, due to the infectious nature of this Coronavirus, the lack of early symptoms when the virus is considered most infectious, reflective of some people appearing almost asymptomatic and, the prevalence of international travel in modern society that allowed the virus to spread so quickly across the globe. As at the 31st March 2020, confirmed Coronavirus cases total 803,650 with now c.90% of confirmed cases outside of China. This represents the significant shift in the spread of this virus from a few weeks ago and highlights the fluidity of the situation.

The read-through to financial markets

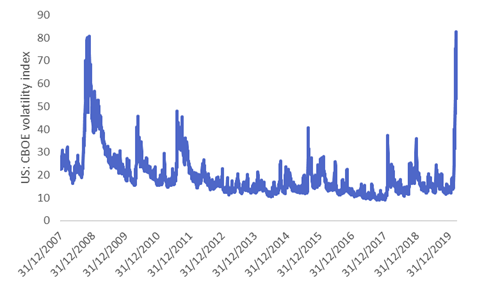

From the chart below, it is apparent that financial markets have been in a noticeable period of elevated volatility since the 24th February (as measured by the US Volatility (VIX) index) and we expect to remain in a period of heightened volatility for some time, although please remember past performance is not indicative of future results

Source: FactSet, CBOE Volatility (Vix) Index. Data from 31 December 2007 to 31 March 2020. The VIX index is a measure of expected future volatility (market ups and downs) for the US S&P 500 equity index over the next 30 days. The figures shown relate to past performance. Graph for illustrative purposes only.

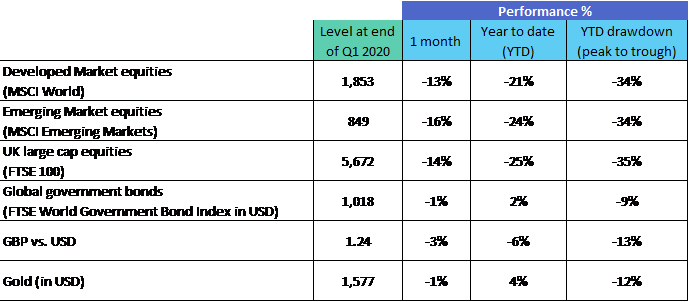

Investors, in the short term, have attempted to reduce their overall risk exposure and sought the protection of more traditional safe haven assets, such as government bonds and gold, relative to riskier equities that have been hit hard, as shown in the table below.

Source: Bloomberg. Data from 31 December 2019 to 31 March 2020. The figures shown relate to past performance. Table for illustrative purposes only.

From the table, it is clear that equity markets have risen off their most recent lows over the past few days into quarter-end. However, we think it is too early to assume that this recovery is sustainable. Yet, we are also conscious that historical upturns in markets can be as dramatic as the downturns, and can still occur even when negative news continues to dominate discourse. Instead, it remains, as important as ever, to pick investments carefully and in-line with long-term investment goals. Our current preference within equities is to favour those higher quality companies that have more robust balance sheets, good profit margins and with structural growth opportunities ahead of them over the longer term.

What has been the public policy response?

The International response has been unprecedented; we have observed ever more coordinated monetary and fiscal easing than under previous economic downturns. Broadly, governments have enacted expansionary fiscal policy through higher government spending and they have either delayed or removed some tax rates in the short term to lessen the economic blow on businesses and consumers. At the same time, central banks have expanded monetary policy by cutting interest rates and embarked upon or expanded asset purchase programmes (quantitative easing) to add liquidity into financial markets. These responses seek to partly mitigate the loss in consumer and business expenditure, which are the major drivers of global economic growth to lessen the depth of this recession. For a more detailed policy overview, the IMF has a useful resource that outlines responses by each country here: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#U

Since we last wrote, the Bank of England (the UK’s central bank) has loosened monetary policy further (on 19th March 2020) by cutting the base rate from 0.25% to 0.1%. This is the lowest level in the central bank’s 325-year history. Alongside this, the Bank of England indicated it would restart asset purchases under its quantitative easing programme announcing a £200bn extension; this represents a c.+45% increase in asset holdings at the central bank, once complete. Likewise, the Chancellor, Rishi Sunak, has ‘gone further’ with fiscal expansion; the government announced job support programmes for those self-employed and under PAYE, a range of cash grants for smaller businesses, business rate holidays for certain sectors (e.g. retail) and £330bn (equivalent to c. 15% of GDP) in government-backed loans.

What next?

Human brains are wired towards placing increased emphasis on short-term thinking and negative information i.e. we psychologically overweight a negative event relative to an equal positive event. From watching the news or reading the headlines, it can become all too easy to form a pessimistic mind-set. We remain conscious of the need to remain as level-headed as possible and spend each day seeking to learn more in an effort to evaluate what that might imply for tomorrow.

From an investment research perspective the research team at JM Finn, try to distinguish between short-term and long-term research priorities. It might not have meant changing portfolio positioning but it has meant continually analysing and re-assessing the investment cases for the asset and companies held for our clients, in light of new information.

Over the past couple of weeks, the team felt it was important to consider the immediate implications of this economic recession by looking at, for example, the balance sheet strength of the companies we hold for clients, to gauge their near term access to liquidity i.e. cash or borrowing facilities; or to estimate the likelihood they may need to raise additional funds from investors to continue operations.

Additionally, we believe it is extremely important to frame the long-term implications for those sectors invested in across the business: the coronavirus pandemic is a world event that will undoubtedly be etched into the psyche of nations globally and impact business and consumer behaviour moving forward. For instance, the food retail sector has seen an immediate uptick in food demand as consumers have stockpiled to increase their own food security. Increasingly consumers have adopted online food delivery and we believe this could, long term, hasten the adoption of online food delivery – if so, this has implications for food retail margins. Equally, the drastic need to adopt remote working practises (where feasible) could accelerate the transition toward cloud computing longer term.

We know the Coronavirus situation remains highly uncertain and subject to continual change but we take some comfort in following our detailed and time-tested approach to fundamental analysis, knowing at some point, the challenges of the pandemic will be overcome. We remain steadfast in our commitment to active investment management and in seeking to take investment decisions that help our clients achieve their long-term investment goals.

This market update was put together by James Ayling our Research Team.