But with careful planning there are ways to limit your tax burden and pass on more of your wealth to your family, particularly now that the rules are changing.

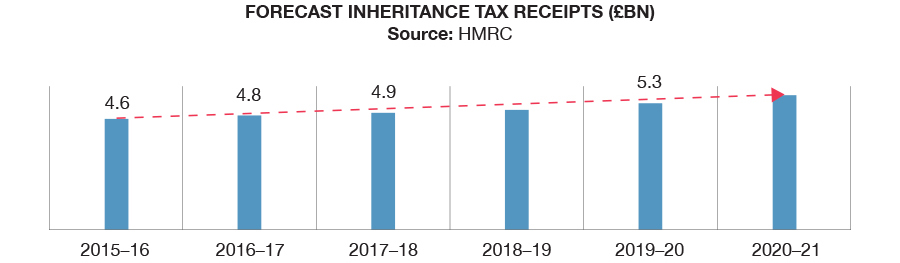

Persistent increases in the value of property, particularly in the south-east of England, coupled with recent record high valuations for equity markets and a frozen IHT allowance, means that the portion of families affected by inheritance tax (IHT) has reached a 35 year high according to the Office for Budget Responsibility. This is a trend which shows no signs of abating. HMRC accounted for £4.7bn of IHT receipts in 2015/16, 22% higher than in 2014/15, with offcial forecasts anticipating this number will reach £5.6 billion by 2020/21.

However, with some personalised advice, to navigate the complex rules and the implementation of appropriate planning strategies, the impact of IHT can be reduced in order to preserve your legacy for your chosen beneficiaries.

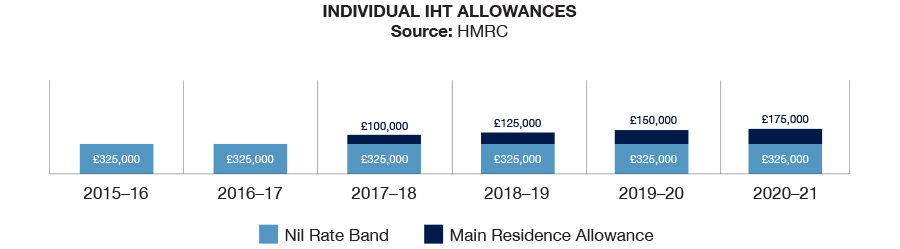

IHT is payable at a at rate of 40% on estate assets in excess of £325,000 (known as the nil rate band) for a single person. Any estate assets that are transferred to a spouse qualify as exempt transfers. Additionally, any unused portion of the nil rate band can be transferred to the estate of the surviving spouse (effectively increasing the nil rate band to £650,000 for the last surviving spouse).

An important change to the IHT rules, which takes place from 2017/18, is an increase in the nil-rate band to include an additional main residence allowance of £100,000 when the residence is passed on to direct descendants (increasing to £175,000 by 2020/21). The new relief is reduced by £1 for every £2 of value in excess of £2m.

Ways to mitigate inheritance tax

Some IHT mitigation strategies are simple whilst others are more complex. The most effective and appropriate strategies deployed by you, to avoid HMRC becoming one of the largest beneficiaries of your estate, will depend on your individual circumstances.

Outlined below are a few smart strategies that should be considered when looking at your overall situation.

Do you have a valid Will and have you considered a Lasting Power of Attorney?

Whilst arguably the most pivotal component to any considered IHT plan, making a valid Will and considering a Lasting Power of Attorney is unfortunately often delayed or overlooked altogether.

Dying intestate (without a valid Will) can unwind the best intentions regarding IHT planning; so a valid, up-to-date and professionally drafted Will should form the foundation of any IHT strategy.

Should you make a gift?

Gifting assets, such as cash, securities or property, during one’s lifetime is one of the simplest methods of reducing IHT liabilities.

An estate can pay IHT at a reduced rate of 36% on some assets if you leave 10% or more of the net value of your estate to a registered charity via your Will. Additionally, individuals can give away £3,000 worth of gifts each tax year without them being added to the value of your estate. If you haven’t used your annual exemption from last tax year, you can carry it forward and use it this year.

Other exempt gifts include wedding or civil ceremony gifts, normal gifts out of surplus income, payments to help with another person’s living costs, and/or gifts to charities or political parties.

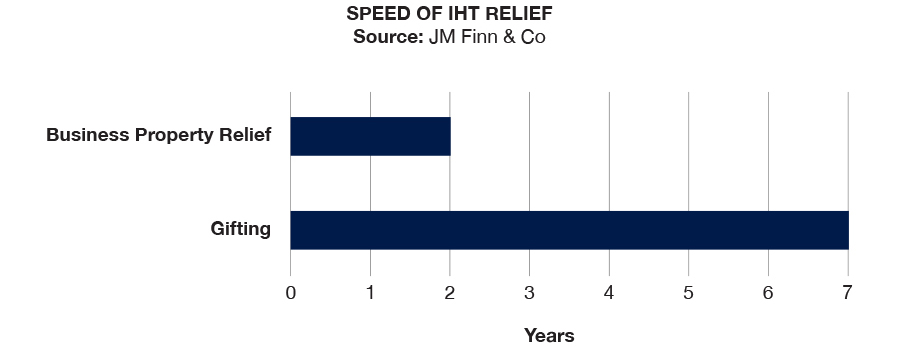

Most other gifts made during your lifetime are ‘potentially exempt transfer’, meaning that they are free of any IHT liability if you survive seven (7) years after making the gift. Gifts made three (3) to seven (7) years before death are taxed on a sliding scale known as taper relief.

- IHT is payable at a at rate of 40% on estate assets in excess of £325,000 (known as the nil rate band) for a single person or £650,000 for a couple

- IHT nil rate band to remain frozen at £325,000 until April 2021

- HMRC IHT receipts reached £4.7 billion in 2015/16: 22% higher than in 2014/15

- The number of families affected by IHT is at a 35 year high

- IHT is due six months after the end of the month in which the deceased died. In certain cases it is possible to pay by annual instalments over 10 years

Have you considered a Trust?

As the new Duke of Westminster would stand testament, the benefits of trusts are that they can be designed so that the assets held therein do not form part of an individual’s estate, thus providing the ability to pass on an enduring legacy free from IHT. Trusts may be used in conjunction with other IHT planning measures, such as gifting of surplus income.

The use of trust structures can yield substantial benefits but need not be reserved solely for the use of nobles. Typical trust structures employed for IHT purposes include:

- Discretionary Trust

- Absolute/Bare Trust

- Discounted Gift Trust

- Loan Trust

The appropriate trust solution depends on individual requirements, such as:

- The need/desire to retain access to income and/or capital from the trust;

- The ability to make large trust contributions (i.e. in excess of the £325,000 nil rate band) without incurring an immediate tax charge; and

- The flexibility to alter the beneficiaries of the trust.

How can Business Property Relief shelter assets from IHT?

Business Property Relief (BPR) was introduced in the 1970s, initially to help owners of family businesses keep it in the family as the business passed through the generations.

Shares held in BPR qualifying companies can be left to beneficiaries free from IHT, provided they have been held for at least two years at date of death.

Importantly, some of the shares that trade on the Alternative Investment Market (AIM), a sub-market of the London Stock Exchange, as well as the NEX Exchange Growth Market qualify for BPR.

Whilst investing in a BPR qualifying portfolio via either of these two markets carries higher risk characteristics than other IHT strategies, the speed at which IHT exemption is gained can offer benefits over a traditional gifting strategy. Additionally, assets are not locked up and can be accessed any time, so if circumstances change you can withdraw your funds, subject to the liquidity of the underlying investments, albeit without qualifying for BPR.

Refocusing on pensions

Pension reforms have made it more attractive to pass on retirement savings. From 6 April 2015, wealth accumulated within pensions can cascade down the generations – or to anyone else of your choosing.

Under the new rules, if an individual dies before age 75, any pension benefits that are left to beneficiaries may be taken tax-free as an income or lump sum. Your beneficiaries may even opt to keep the funds invested in a pension wrapper. For death after age 75, the pension proceeds will be taxed as earned income of the recipient, which can be carefully proactively managed from a tax perspective.

Using insurance proceeds to fund your IHT liability

Insurance policies, such as whole-of-life contracts, can also be used to fund IHT liabilities. Once the IHT liability has been calculated, a policy can be written to provide for the expense. Policies are generally best structured within a trust where the proceeds are free from IHT.

Whilst this strategy can be quite simple to understand, the cost of the premiums and underwriting requirements may provide some limitations.

Action Points

We would encourage you to review your current Will and Lasting/Enduring Power of Attorney to ensure that the arrangements continue to reflect your wishes.

You should contact pension provider(s) to ensure that you have an ‘expression of wish’ for each of your pension plans which reflects your wishes on death.

Take specialist advice on the best course of action to follow in order to provide your beneficiaries with the legacy you want.

The points made in this article are for illustrative purposes only and if you require any assistance with any of the above opportunities in relation to your personal circumstances, contact your investment manager who can make an introduction to our specialist wealth planning team.

It is important to note that JM Finn & Co is not a tax adviser and where tax advice is required, we would look to work with your existing advisers or refer you to a trusted external tax specialist.