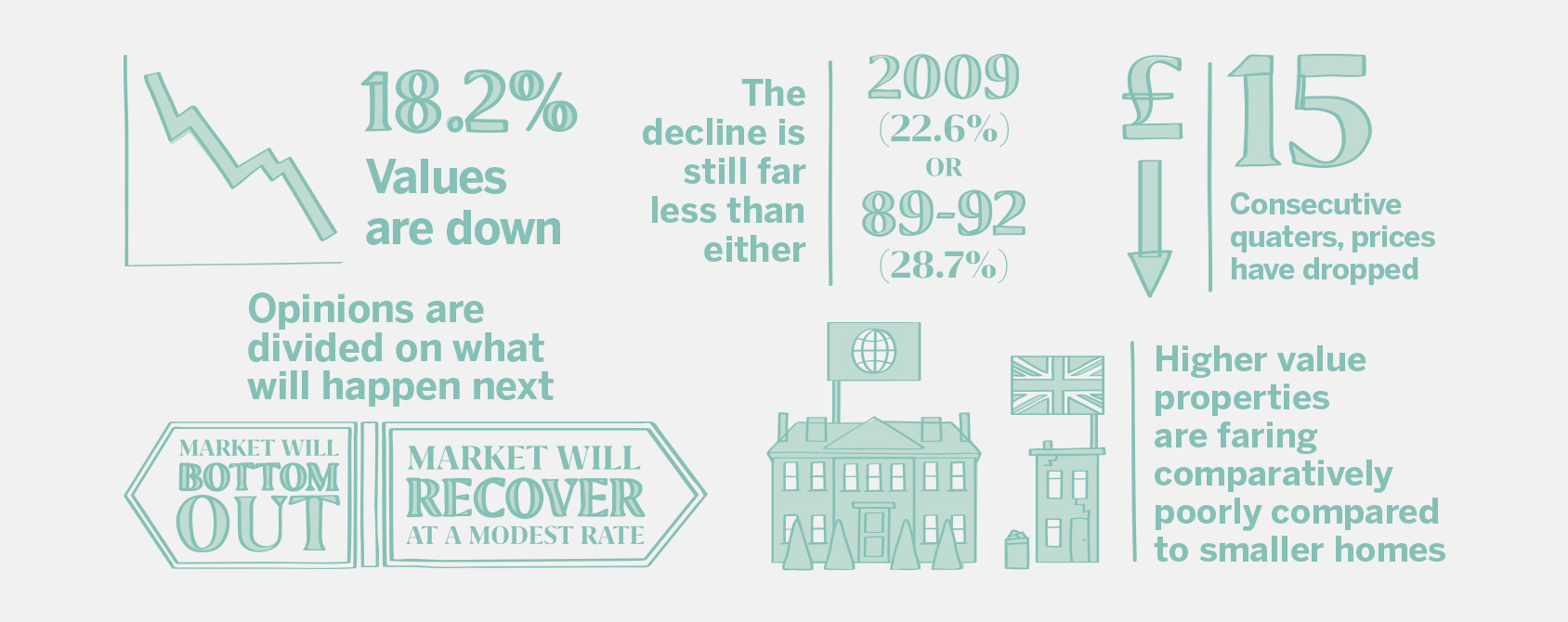

Opinions are divided on what will happen next. Many estate agents point to signs that “the market is bottoming out” and that now may be the time to buy. However, a more bearish view is that further price drops are inevitable and when the market does recover it will do so at a more modest rate than many would anticipate. While the decline has been longer than in previous downturns, it is still far less than the levels of price deflation seen in 2009 (22.6%) or 1989-92 (28.7%). As London is seen as a good long-term bet and the costs of holding the asset is low, the incentive to sell is more limited and the market therefore illiquid.

Before there can be recovery, the market must adjust to a number of headwinds. Firstly, London witnessed phenomenal price growth between 2009 and 2014. In certain areas, capital values doubled owing to both domestic and international demand fuelled by quantitative easing. Despite the subsequent price drops, the reality is that in most areas prices are only back to the levels witnessed a couple of years prior to the market turning.

Secondly, new and significant barriers to entry have been put into place, including high rates of SDLT (the liability for a £5m second home being £663,750) and new measures taxing both offshore individuals and properties held in offshore companies.

Thirdly, while there has been a decline in capital values, rents have also dropped and gross yields remain at between 2-3% which is the level witnessed in 2013 (i.e. just prior to the market turning).

London is unquestionably a vibrant and interesting place to either live or have a home but remains expensive in a global context even after the recent price drops. In light of the headwinds that continue to face the market, is it sensible to investigate alternative means of living in London but reducing your exposure to the market?

The first, obvious solution is renting. Rents have barely changed over the last fifteen years and with gross yields at 2-3% one could employ capital elsewhere. The SDLT liability on a £5m flat covers the cost of renting an equivalent for approximately six years in Prime Central London. So, if a purchaser is of the opinion that the market is going to decline and/or that SDLT may be amended, is it not better to rent in the interim?

However, if renting is seen as too temporary, Grosvenor has a number of flats in and around Eaton Square which trade relatively regularly on leases of up to 20 years. They are granted as such so that the Lessee will not be able to extend the lease under the terms of the Leasehold Reform, Housing & Urban Development Act 1993 (as amended). With a full term of 20 years, these leases trade at approximately 40% of an equivalent 100 year lease. While the lease is a diminishing asset, it can be sold on. In addition, the SDLT liability is significantly reduced and any further decline in the market is reduced by the more limited capital investment. These leases work particularly well with older buyers wishing to release money to their children and effectively pay their IHT liability to Grosvenor instead. As my former employer also remarked: “no one asks how long your lease is when they come to dinner.”

Short and mid term leases are still relatively common throughout Prime Central London, those that were granted for a term of in excess of 21 years (by far the majority) have a higher resale value for the obvious reason that the Lessee has a statutory right to extend their lease. That said, a 20 year lease with this right would still probably only achieve 55-60% of the value compared to a 100 year lease. A buyer can wait to see if the market recovers in the knowledge that they will have a right to extend and there is currently political pressure to make the world of Leasehold Reform simple and cheaper for a Lessee.

Even if a buyer does not extend their lease or, indeed, chooses to buy a very short lease which would have previously been snapped up by a dealer seeking to extend, refurbish and sell on, they may be able to remain on as an Assured Tenant (i.e. with security of tenure for their lifetime) at the end of the lease; this is subject to it being their primary residence and certain rateable value limitations. The basis of this is set out in the Local Government & Housing Act 1989.

For those, such as myself, who derive a living from the Prime Central London market, it is sorely tempting to call the bottom of the market but I do not think that we are quite there yet. There will be those that take a long-term view and recognise that property (quite rightly) is not just an asset but something to enjoy. For those that cannot quite stomach a punitive tax on purchase and a potential further decline, there are viable alternatives for delivering the privilege of living in London.