Since our founding in 1945, it has been our mission to provide unparalleled service and investment management expertise to our clients and we firmly believe that we continue to meet our goals today. However, the industry has evolved significantly since our days as a stockbroker, with integrated wealth management becoming more prominent, an ever increasing reliance on digital services combined with a more refined focus by the regulator, the FCA, all of which are changing the shape of the business. To get a meaningful picture of our clients’ attitude towards JM Finn & Co we required an independent view.

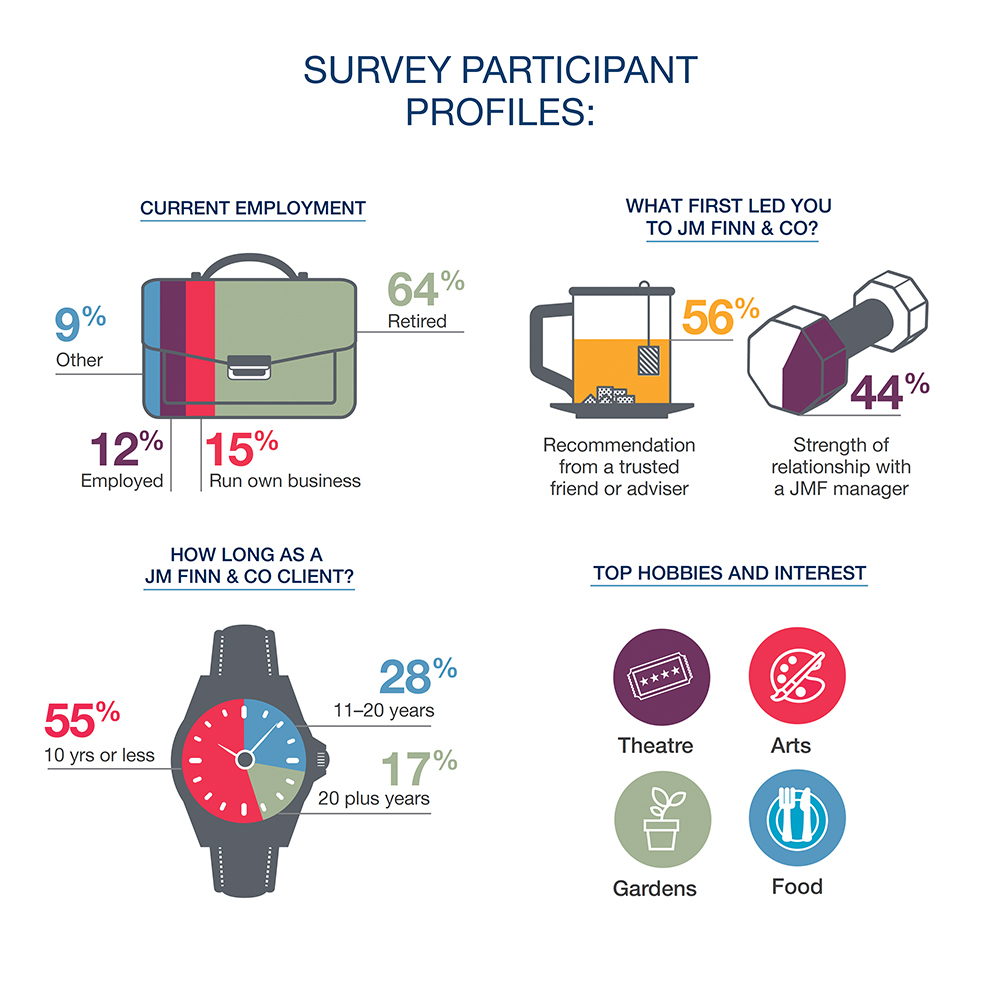

To this end, we engaged an external research consultant, Scorpio Partnership, following a competitive pitch process, to undertake the study. We were delighted by our clients’ response, with over 1800 completed surveys, representing nearly a quarter of all those invited to participate. In statistical terms, this provided a 99% confidence level with a confidence interval of 2.61 (see box on page 25 for explanation).

Part of the insight gained from this exercise focussed on the general perception of the firm by our clients. Asked to select up to five qualities that are associated with JM Finn & Co, the top five answers are all qualities we endeavour to instil in our staff in their pursuit of delivering client satisfaction: Ethical, Stable, Transparent, Efficient and Professional.

When respondents were asked to rate their most important attributes about JM Finn & Co, we were not surprised to learn that way out on top of the list was the access to an individual Investment Manager. We see this as an important distinction for the firm; whilst many other investment management businesses are shifting towards a relationship manager model, we are resolutely staying true to our approach whereby each client has a dedicated investment manager – as we believe this is how we can continue to deliver the personal level of service that our clients are telling us they value.

THE TOP FIVE ATTRIBUTES OF CLIENT SATISFACTION WERE

- Access to an individual investment manager

- Investment performance

- Understanding client requirements

- Market knowledge

- Personal relationship and empathy

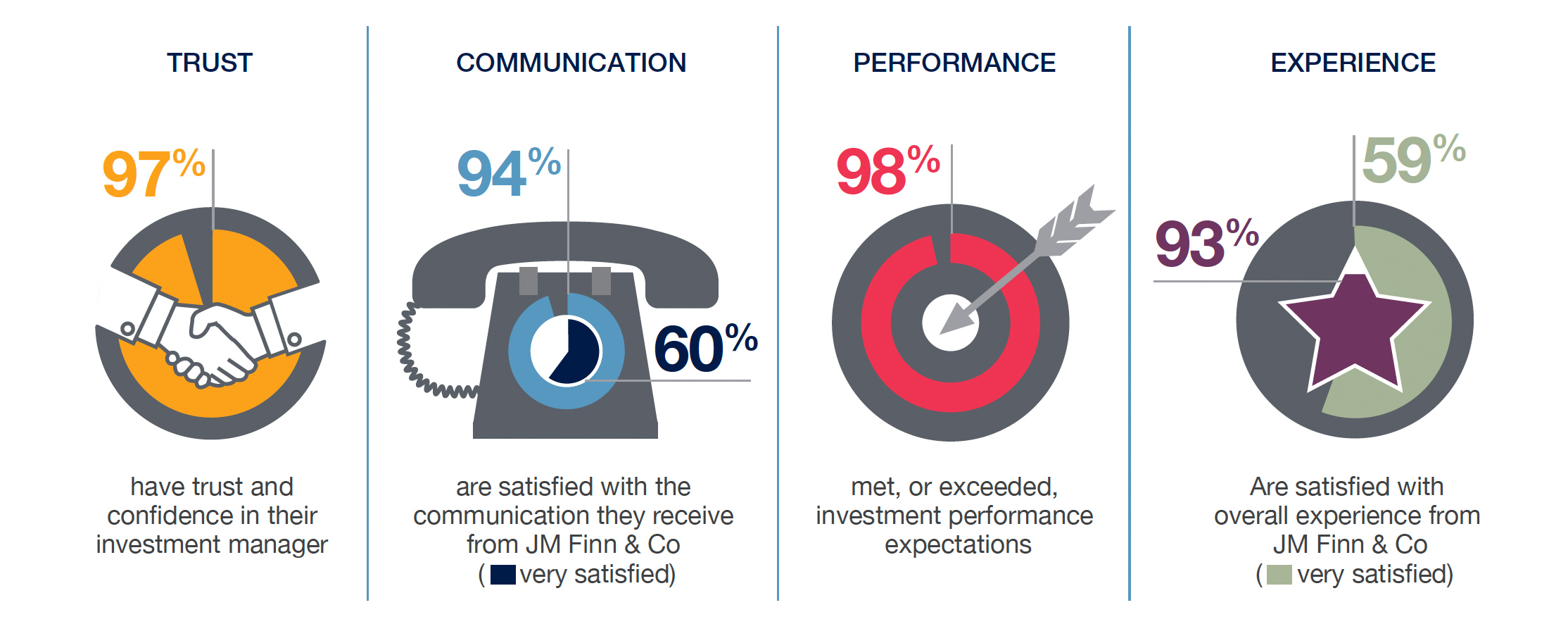

As many loyal followers of JM Finn & Co will know, our business is built around discretionary portfolio management and two key attributes to a successful client relationship are trust and communication. We explored the level of trust our clients had with us and were delighted to learn that 97% have trust and confidence in the individual who acts as their investment manager and 96% have trust and confidence in the firm as a whole. Interestingly only 40% of respondents had trust and confidence in the financial markets, hence the need to work with a professional investment manager to help them navigate the world of finance.

Communication is also an important aspect of the service we offer, as good discretionary management is supported with good communication. Our clients agree with us as 94% of responses expressed satisfaction with the communication they receive from JM Finn & Co (of which 60% were very satisfied!)

When exploring our clients’ preferences for using digital services, the primary reason for using an online account was to view up to date portfolio valuations. However, we expected clients to be looking to use the online facilities to reduce the amount of paperwork they receive from us, as we know this industry (and therefore our offering) is over-burdened by administrative paperwork. We will continue to develop the personal library on our website so that clients can have access to all their correspondence digitally, as we believe this will be of increased importance to our clients in the future.

“My investment manager is excellent. Always available to me, understands my needs, offers a personal service and ensured my portfolio performs beyond expectation.” Client of JM Finn & Co

Of course, the goal of our investment management services is to meet our clients’ individual investment objectives and we are ultimately judged on the investment expertise we can offer. To this end, we were delighted that 98% of our clients confirmed that we have met, or exceeded, their investment performance expectations. We strive to provide a personalised level of portfolio management services which are tailored to individual clients’ specific investment objectives and this result endorses our approach.

Based on the levels of trust and satisfaction of our communications and investment performance, we were very pleased that 93% of our clients stated they were satisfied with their experience of dealing with JM Finn & Co, and 59% stated they were very satisfied.

Receiving confirmation of our clients’ perceptions towards our services has been very valuable, and has endorsed our approach to the business. We also used the survey to explore other services our clients might require. Inheritance planning ranked highly, followed by pension advice and retirement planning, particularly by the under 50s. This information will be invaluable as we look to ensure our proposition is relevant for future generations of investors. Loyalty is a quality that all companies look for, both from their staff and their clients, and is a strong feature of all the attributes that we have mentioned already.

Loyalty is often measured by a combination of share of wallet, i.e. in our case, how much of an individual’s net investable assets do we manage, and a metric known as the Net Promoter Score (NPS). Although more traditionally used for retail brands, the NPS can give a useful insight into the general level of loyalty a firm generates from their clients. On average, we manage over 55% of our clients’ investable assets; a clear indication of the level of confidence in JM Finn & Co.

These are the high level findings from our survey but it goes without saying that we were delighted with the responses and hope you will be interested in this feedback and forgive us blowing our own trumpet a little. Your responses have set the bar pretty high and we will be looking to continue receiving the same level of plaudits in years to come. We will also refer back to these findings as and when we look to make any strategic decisions regarding the direction of the firm.

Loyalty is a quality that all companies look for, both from their staff and their clients, and is a strong feature of all the attributes that we have mentioned already. Loyalty is often measured by a combination of share of wallet, i.e. in our case, how much of an individual’s net investable assets do we manage, and a metric known as the Net Promoter Score (NPS). Although more traditionally used for retail brands, the NPS can give a useful insight into the general level of loyalty a firm generates from their clients. On average, we manage over 55% of our clients’ investable assets; a clear indication of the level of confidence in JM Finn & Co.

These are the high level findings from our survey but it goes without saying that we were delighted with the responses and hope you will be interested in this feedback and forgive us blowing our own trumpet a little. Your responses have set the bar pretty high and we will be looking to continue receiving the same level of plaudits in years to come. We will also refer back to these findings as and when we look to make any strategic decisions regarding the direction of the firm.

“The reason and the continuing reason I am with JM Finn is due to the excellent service provided by the team.” Client of JM Finn & Co

We have long been a company that puts its clients first – many companies say this, but with our management committee consisting of senior investment managers who actively manage client portfolios, each and every decision that is made is looked at from a client perspective. We believe this will stand us in good stead as we provide investment management services long into the future; and we hope our clients will agree.

CONFIDENCE INTERVALS

The confidence interval (or margin of error) is the plus or minus figure usually reported in opinion polls. For example, if one uses a confidence interval of 4 and 47% of the sample pick a certain answer, you can be “sure” that if you had asked the question of the entire relevant population, between 43% and 51% (47% + or – 4) would have picked that answer.

CONFIDENCE LEVEL

The confidence level tells you how sure you can be. This is expressed as a percentage and represents how often the true percentage of the population who would pick an answer lies within the confidence interval. A confidence level of 95% means you can be 95% certain. When putting the two numbers together, you can say that you are 95% sure that the true percentage of the population is between 43% and 51%.