Summary— The annual allowance is the most you and your employer can save into your pension within a tax year before you are required to pay tax on those contributions.

— There are limits to the tax relievable contributions that can be paid.

— The annual allowance may be reduced if you have either flexibly accessed your pension pot previously or you have a high income.

— The annual allowance was reduced by £1 for every £2 of adjusted income over £150,000.

— Anyone with an adjusted income of £360,000 or above is now restricted to an annual allowance of only £10,000.

— The consequences of not being aware of these caps could be a tax charge known as the annual allowance charge.

— It might be possible to carry forward any unused allowances from the previous three tax years.

Depending on your taxable income the excess pension savings can be charged to tax in whole or in part at your marginal rate of income tax. In the 2023/24 tax year the annual allowance stands at £60,000.

However, there are limits to the tax-relievable contributions that can be paid. For personal contributions, you are permitted to make contributions of up to the greater of £3,600 or 100% of your annual earnings each tax year, capped at the annual allowance, in order to receive tax relief on them.

However, your annual allowance may be reduced if you have either flexibly accessed your pension pot previously or you have a high income.

To focus on the latter point, as of the 6th of April 2016, a tapered annual allowance was introduced for higher earners, for which an individual’s annual allowance was reduced by £1 for every £2 of adjusted income over £150,000 provided your threshold income did not also exceed £110,000. Adjusted income broadly being all taxable income plus employer pension contributions and threshold income broadly being all taxable income less personal pension contributions.

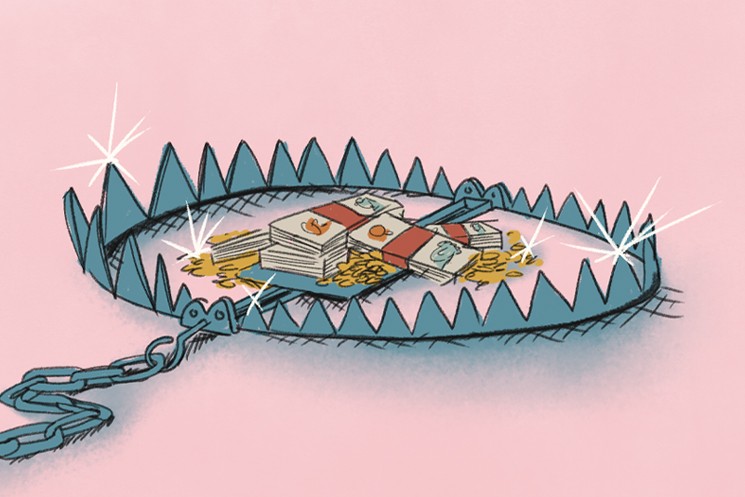

The annual allowance is a tax trap that is ensnaring individuals due to its complexity.

However, as of the 2023/24 tax year, the rules changed in such that for every £2 of adjusted income over £260,000 (increased from £240,000), an individual’s annual allowance is reduced by £1. This is good news for many who were previously restricted by this taper but will still serve as a bane to some. For higher earners still impacted by the taper, the minimum tapered annual allowance was increased from £4,000 to £10,000. This means that anyone with an adjusted income of £360,000 or above is now restricted to an annual allowance of only £10,000

The calculation of annual allowance for higher earners can be the source of some confusion as there are numerous elements at play and as a minimum an individual would be required to know their income amounts chargeable to income tax and pension savings (including employer contributions) for the relevant tax year. This can be particularly troublesome for those with variable income arising from multiple sources. The consequences of not being aware of these amounts could be a tax charge known as the annual allowance charge. In order to calculate the charge applicable the total gross amount that has been contributed to pensions in excess of your annual allowance is added to your income for the year and then income tax is applied. For earners in excess of £260,000 threshold this would likely be 45%. This charge will be payable by the individual even in the case where the annual allowance has been exceeded through employer contributions. Subject to certain conditions it is possible to have the charge paid from your pension however, this is still not a situation many people would wish to find themselves in.

If you believe that you may be subject to the tapered annual allowance and as a consequence be subject to an annual allowance charge it is important to check with your accountant who will be able to work out your annual allowance and help you adjust your contributions accordingly. We have seen numerous high income individuals incur a large annual allowance tax charge as they were under the impression that they could pay in £40,000 (now £60,000) but were in fact restricted by this tapering. It is a tax trap that is ensnaring individuals due to its complexity, and often it is clients who do not employ the services of an accountant who fall foul of the rules.

It might be possible to carry forward any unused allowances from the previous three tax years. Ultimately this is a complex issue and one that could be detrimental to your long term financial planning were you to incur a large unanticipated tax charge however, this can be easily amended by proper and regular surveillance and seeking help from appropriately qualified individuals.

Investment involves risk. The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested.

The information provided in this document is of a general nature. It is not a substitute for specific advice with regard to your own circumstances.

Any views expressed are those of the author. All figures were correct at the time of going to print. You are recommended to obtain professional advice before you take any action or refrain from action. You should contact the person at JM Finn with whom you usually deal if you wish to discuss any of the topics mentioned.

Click here for more articles from our Pension Report

Beware - the tax trap whose bite is worse than its bark

Download