Wealth planning in focus

Key measures from the UK's Budget - and their potential impact.

Luke Audritt explains what you need to know about self-invested personal pensions – and why they remain an appealing way to save for retirement.

Luke Audritt looks at the practical considerations of exiting a business to try to ensure that disposal is tax efficient, and to make the sale proceeds of your blood sweat and tears work as hard as…

Lending for equity release mortgages is up 32% compared to 2024, driven by older generations seeking to fund retirement.

With more estates being caught by Inheritance Tax, could offshore bonds play a role in your strategy for gifting wealth away to your family?

The Autumn Budget threw an unexpected curveball by including pensions in estates for inheritance tax purposes. Ryan Gordon of the JM Finn Wealth Planning team considers the possible impact on…

Charles Barrow, Associate Wealth Planner, discusses the importance of early planning for inheritance and speaking to loved ones about where assets are kept in order to pass on as much of your wealth…

Charles Barrow, Associate Wealth Planner and Mark Rowe-Ham, Senior Investment Manager explain why it might sometimes be best to sell underperforming shares and incur Capital Gains Tax.

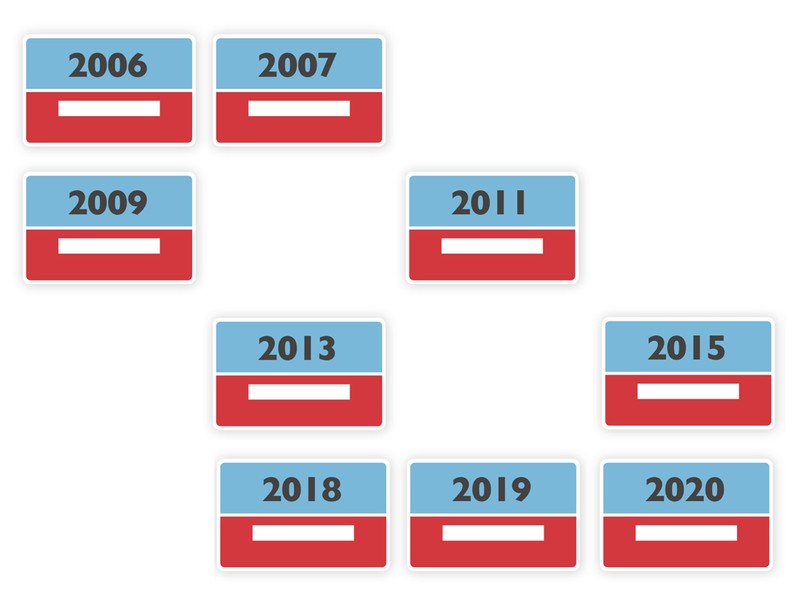

As the UK government has recently launched its new online state pension checker tool, Ryan Gordon reminds us of the April 2025 deadline to ‘top up’ missing National Insurance years dating back to…

Ryan Gordon from the JM Finn Wealth Planning team shares advice on the ways in which we can help to plan for and mitigate against the effects of the school fee increases which may well come with a…

Michael Law, Paraplanner at JM Finn delves into the possible circumstances where purchasing an annuity may be beneficial, and explains why annuity sales are currently elevated.

Rebecca Dawkins, Associate Wealth Planner at JM Finn, explains the rules on topping up missing National Insurance years to potentially increase state pension income.

Rebecca Dawkins, Associate Wealth Planner, and Anna Murdock, Head of Wealth Planning review the impact of the changes announced in the Spring Budget.

Personal taxation is a complicated matter and getting to grips with how you are taxed is not made easier with annual Government alterations to the UK tax rules. We asked paraplanner, Ryan Gordon to…

If you like this article, follow us for more insights.

To receive more content like this subscribe today.