Editorial

Train ticket prices and delays are a perennial collective gripe for the nation: Henry Birt considers whether the government’s renationalisation programme will prove to be the answer.

William McCubbin explores the timeless allure of gold, from ancient times to today – and why its appeal to investors as a safe haven asset is stronger than ever.

Share prices of “Big Tech” companies have risen dramatically in recent times, yet these behemoths have come under increasing regulatory scrutiny. With a new administration recently occupying the…

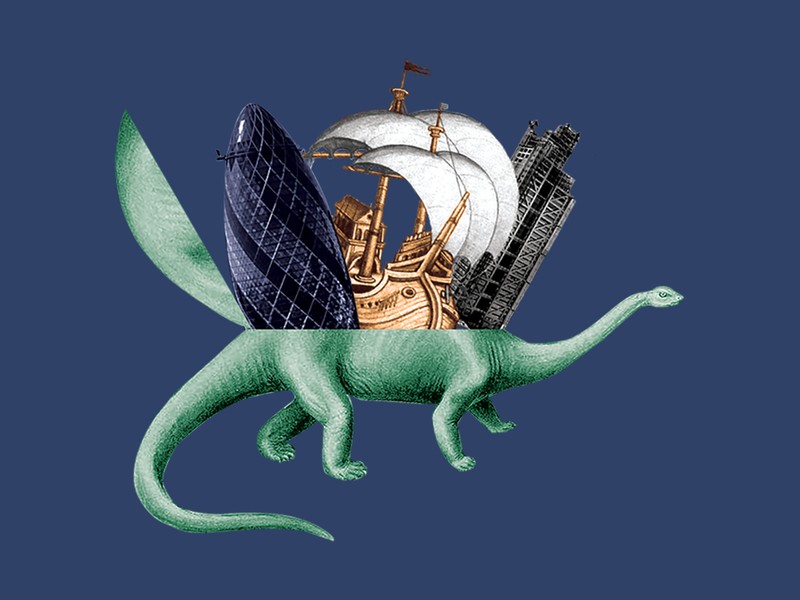

Assistant Research Analyst William McCubbin gives a potted history of Japan’s extraordinary economic development over the last 70 years.

Charles Bathurst-Norman, Investment Director, discusses why so many American companies are moving their supply chains closer to home, and the impact this is having on the US economy.

Henry Birt explores the history of semiconductors and the global geopolitical tensions that have arisen from these nanoscopic devices.

As half of the world’s population heads to the polls this year, Charles Bathurst-Norman analyses the potential ramifications for economies, international trade and the global investment landscape.

Despite ostensible issues with governance, capital allocation and succession planning, many public family owned companies surpass the average performance of their respective industries, writes Nina…

As interest rates hit a 15-year high on the back of stubbornly high inflation, returns on certain gilts have been a ray of sunshine for some investors seeking an income. Sir John Royden, Head of…

Michael Bray, Senior Research Analyst examines the reasons behind the ongoing decline in UK equity listings, and asks what can be done to reverse the trend.

Media commentators have repeatedly remarked on the impending ‘death of the high street’, threatened by the apparent unrelenting rise of the internet and online stores.

Head of Research, John Royden looks at the unintended consequences of consumer protection and suggests an alternative approach to banker’s remuneration.

The guns versus butter dilemma has occupied civilisations for millennia and the civilisation that often jumps to mind is Rome.

Have you ever wondered why bond exposure is so often achieved via bond funds and not through direct investment?

If you like this article, follow us for more insights.

To receive more content like this subscribe today.