Our insights

Charles Barrow, Associate Wealth Planner and Mark Rowe-Ham, Senior Investment Manager explain why it might sometimes be best to sell underperforming shares and incur Capital Gains Tax.

Firm accepts three awards at Citywealth gala ceremony.

Investment Director Andrew Mann covers the UK's wage growth, inflation and unemployment rates in his latest commentary.

Henry Birt explores the history of semiconductors and the global geopolitical tensions that have arisen from these nanoscopic devices.

With Labour widely tipped to take a parliamentary majority at the next election, Allen Simpson considers the potential economic impact of a Labour government.

Have you thought about gifting to charities – and what might be the best way to go about it? Chris Thurlow explains why charitable trusts can offer a rewarding and tax-efficient way to maximise the…

Sir John Royden, Head of Research at JM Finn, gives an overview of cashflow matching.

The modified duration (“MD”) of a bond is a measure which describes the relationship between a bond’s price and interest rates.

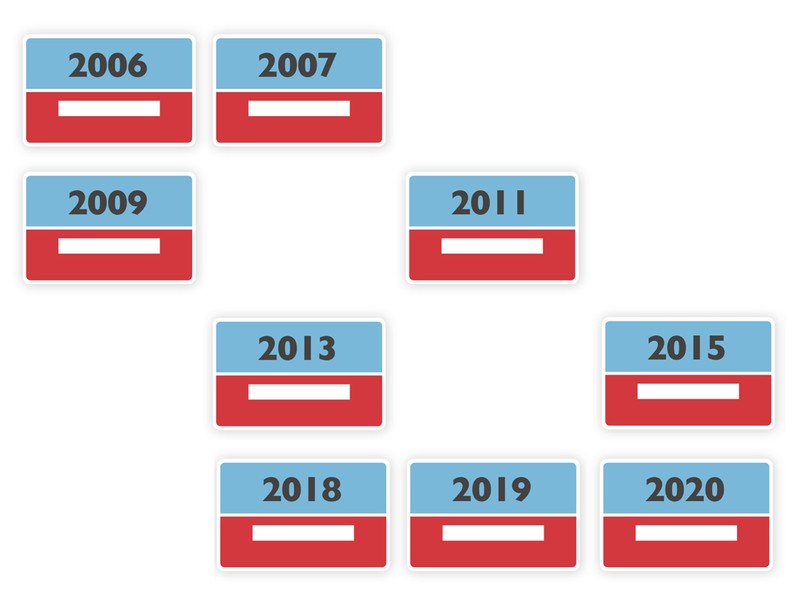

As the UK government has recently launched its new online state pension checker tool, Ryan Gordon reminds us of the April 2025 deadline to ‘top up’ missing National Insurance years dating back to…

Following the opening of our York office in 2023, JM Finn is now proud to partner with the York Art Gallery through sponsorship of the National Treasures exhibition.

Glossary of key terms for the Summer 2024 edition of Prospects.

As part of our focus on providing a high quality, personalised investment service, we look to support our investment managers in their decision making when it comes to constructing client portfolios.

A spotlight on three of the companies we’ve met during the past quarter. We met or spoke with the companies below and you can learn more on any of these by contacting the person at JM Finn with whom…

William McCubbin, Assistant Research Analyst at JM Finn looks at luxury group LVMH in depth.

If you like this article, follow us for more insights.

To receive more content like this subscribe today.