More information

How can we help you?

Single Column (WYSIWYG) component

Text goes here

Updates to reporting requirements under Automatic Exchange of Information (AEOI) regime – could your trust be affected?

Andrew Mann explains why the consumer goods giant has moved its ice cream brands into a newly listed company.

Andrew Mann asks whether we are witnessing the beginning of a more serious correction in AI stocks, or simply a necessary pause after a period of rapid growth.

JM Finn Event Feedback Form

Would our clients refer JM Finn?

The final important metric of our success when it comes to measuring client service quality, is the increasingly common Net Promoter Score, testing the willingness of our clients to refer us. At 71%, we believe this is the highest across the industry, far outstripping the benchmark at 49%.

I'm editing the demo page

Awards

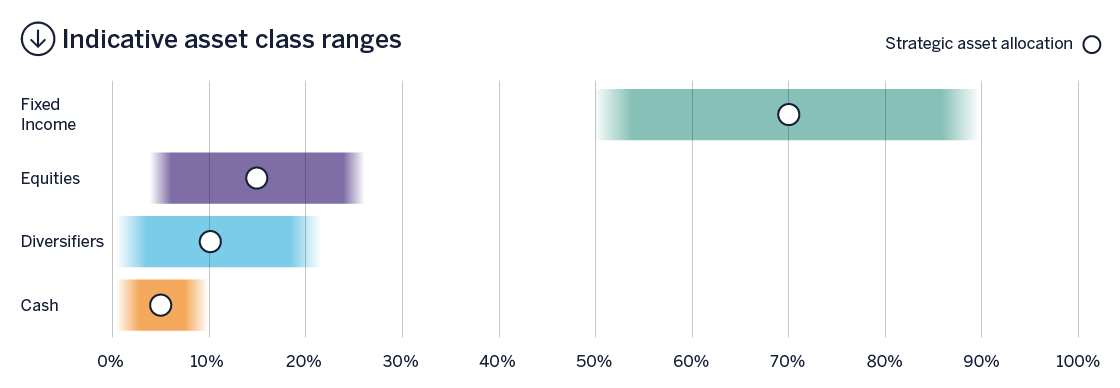

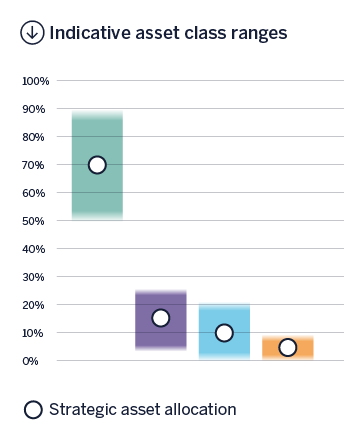

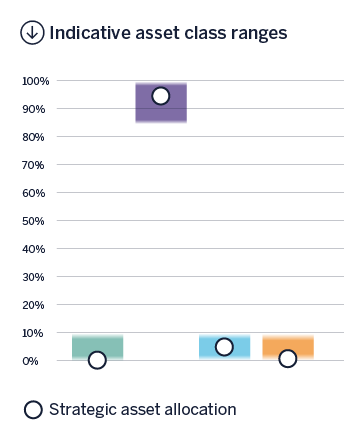

Cautious

This is our lowest risk strategy and may be suitable for an investor with a low risk tolerance looking to generate a return over time which exceeds the return available on cash deposits.

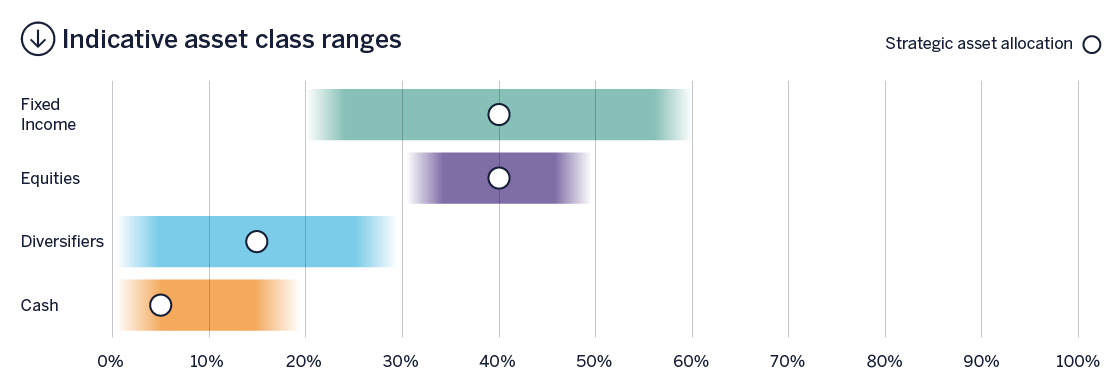

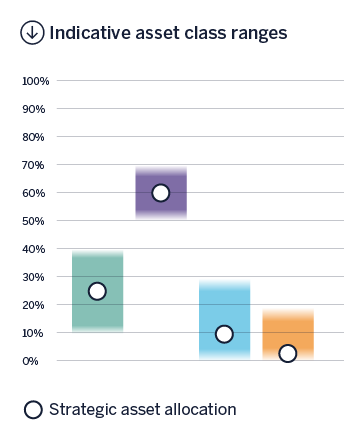

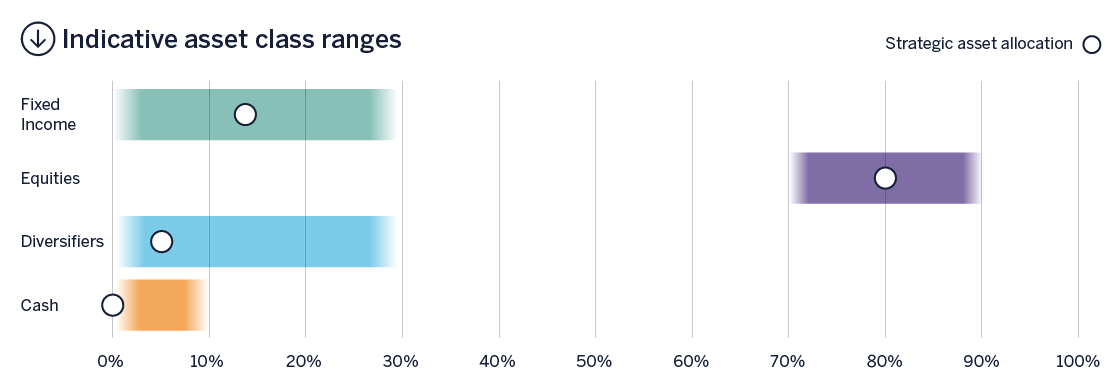

Conservative

With moderate exposure to equity investments this strategy represents low risk and can be suitable for investors looking for a return and willing to accept a degree of loss.

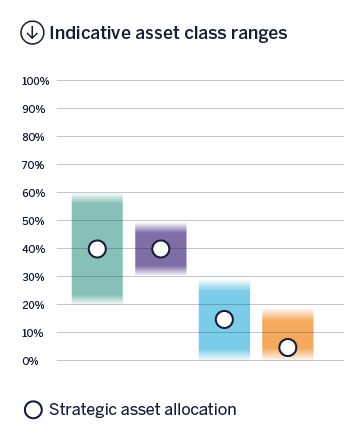

Moderate

A higher and significant exposure to equities offers the potential for greater returns but places a higher level of risk on the investment. Clients in this strategy must be able to accept at least a temporary loss of capital.

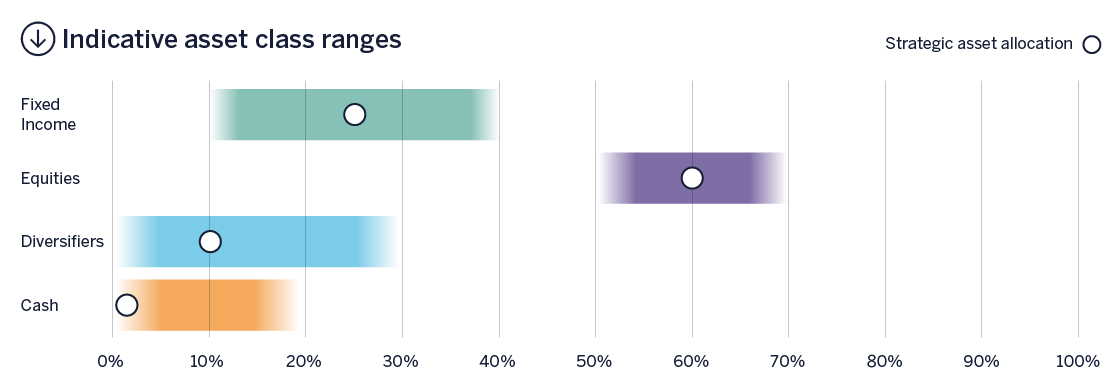

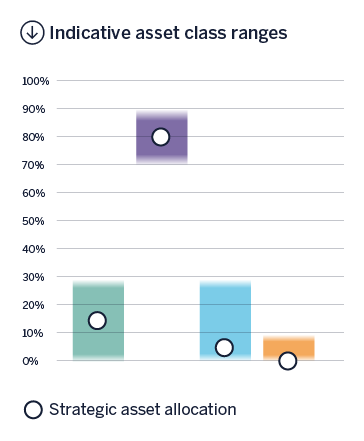

Progressive

With an anticipated 80% of the portfolio invested in equities, this might be suitable for those investors looking to grow their assets but able to tolerate a high risk of losing their capital.

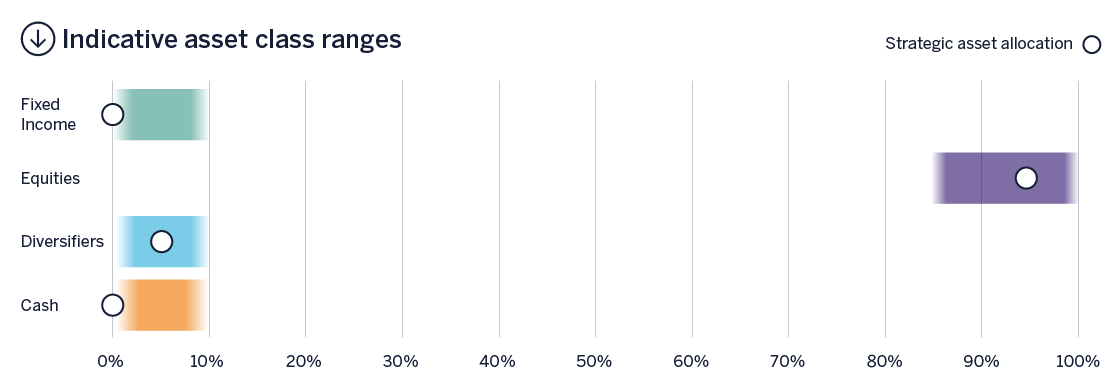

Adventurous

This is the highest risk strategy, with almost all of the portfolio invested in equities. This can be suitable for long-term investors willing to accept a meaningful loss of capital in return for greater returns.